Press Release

JAL Group Announces FY2020 Consolidated Financial Results

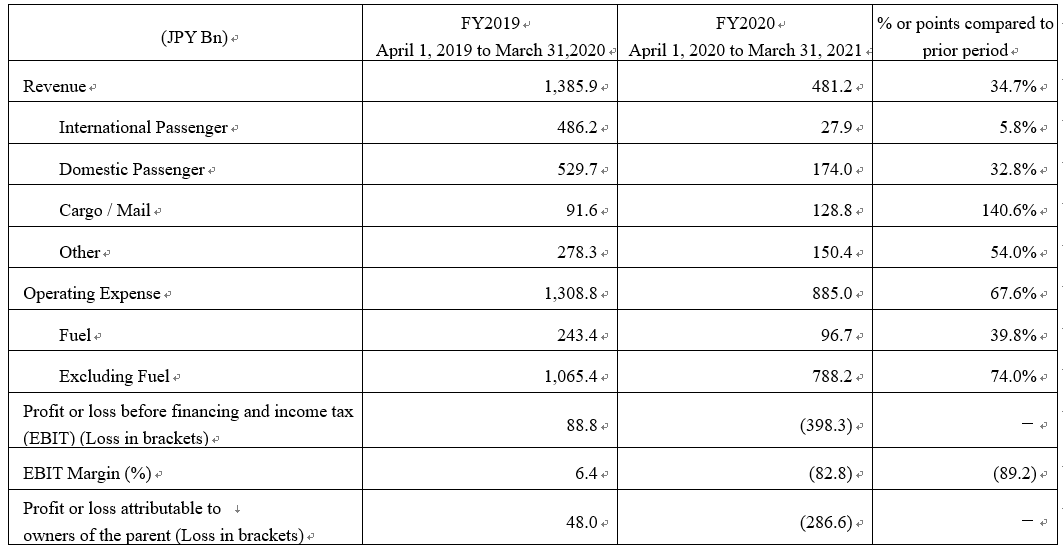

The JAL Group today announced the consolidated financial results for the period April 1, 2020 to March 31, 2021. Beginning this fiscal year, the Company applied IFRS (International Financial Reporting Standards) to the consolidated financial results. In line with this change, the performance management indicator has been changed from operating income to EBIT, which includes both business and investment results.

(1) JAL Group Consolidated Results

This fiscal year (April 1, 2020 to March 31, 2021) was extremely tough for the airline industry, including the JAL Group, due to the impact of the COVID-19 pandemic. As the pandemic spread across the globe, the JAL Group strived to maintain its domestic and international route network, while strengthening hygiene and contactless measures to ensure a safe and secure travel experience. Faced with a rapid and significant decrease in revenue, the carrier implemented fundamental cost reduction measures and, including investments, to mitigate the negative impact of the financial situation. The JAL Group made all possible efforts in this unprecedented crisis, including governmental support to defer tax payments, as well as subsidies for employment adjustment.

Amid this difficult business environment, the Company prioritized “Safety”, the foundation of our business and our management goal, and strived to support the international and domestic network by implementing infection prevention measures for passengers and employees. The below is the summary of our business situation for this fiscal year:

Note: Figures have been truncated and percentages are rounded off to the first decimal place.

※: EBIT Margin=EBIT/Revenue.

(2) Summary of Consolidated Financial Results

International Operations

Severe worldwide restriction on international travel caused passenger demand to diminish due to the spread of the COVID-19 variant. JAL continued to operate minimal international routes for returnees, expats and transit demand from Asia to North America.

As a result, the available seat kilometers (ASK) decreased by 77.9% year over year, the passenger traffic decreased by 96.0% year over year, the revenue passenger kilometers (RPK) decreased by 95.2% year over year, and the load factor was 18.4% for international passenger operations (Full Service Carrier)

The international passenger revenue was 27.9 billion yen, or down 94.3 % year on year.

Domestic Operations

For domestic passenger operations, demand dropped rapidly during the first quarter due to the declaration of a state of emergency in April 2020, but recovered rapidly when the declaration was lifted and subsidized travel promotion campaign called “Go to Travel” started in Japan.

However, due to the rebound of infections, the declaration of a state of emergency was reissued in January 2021 and prior to that, the “Go to Travel” promotional campaign was suspended in December 2020. Amid the unstable situation, the carrier maintained to operate a limited domestic network for essential transportation, including remote islands. JAL Group operated additional flights to provide alternative transport due to a strong earthquake in Fukushima in February 2021.

The available seat kilometers (ASK) decreased by 46.3% year over year, the passenger traffic decreased by 66.5% year over year, the revenue passenger kilometers (RPK) decreased by 66.2% year over year, and the load factor was 47.7% for domestic passenger operations.

The domestic passenger revenue was 174 billion yen, or down 67.2 % year on year.

Freight/Mail Operations

In cargo operations, as most airlines canceled flights, resulting in reduced cargo capacity, the demand-supply situation tightened for the industry. During these situations, the JAL Group decided to support logistics in both the domestic and global market by operating 15,299 passenger aircraft for cargo flights in total, while maximizing its revenue as well.

Also, the carrier is currently striving to establish both domestic and international logistical supports for vaccines for COVID-19, which are expected to arrive in large scale from 2021.

The cargo and mail revenue was 128.8 billion yen, or up 40.6 % year on year.

LCC Business Operations

In the LCC business, JAL Group`s new international mid- and long-haul carrier, ZIPAIR Tokyo (hereinafter referred as ZIPAIR) launched its Tokyo=Bangkok and Seoul routes in June 2020 and the Tokyo=Honolulu route from December 2020. ZIPAIR also introduced the first inflight self-ordering and payment system to realize “contactless” service.

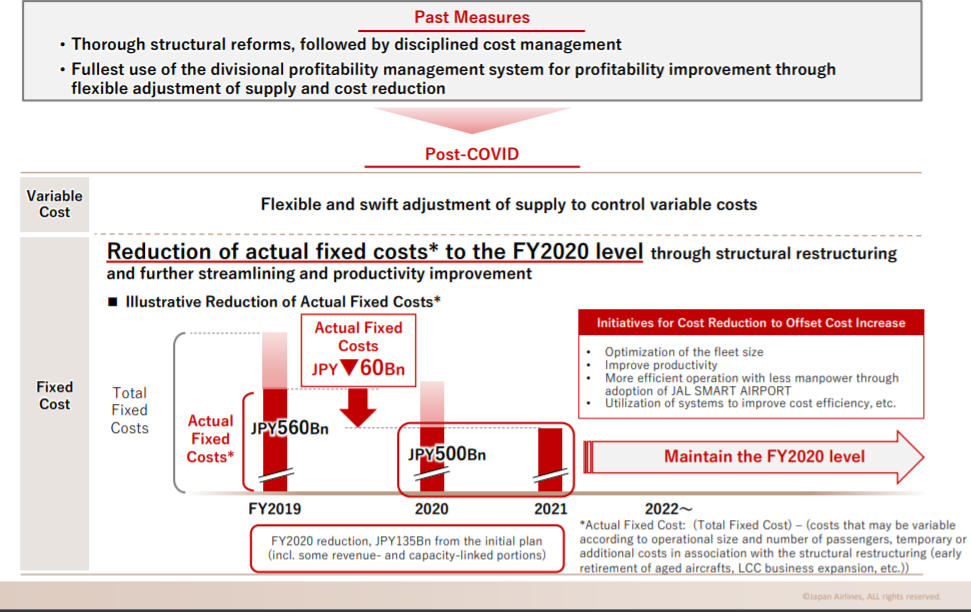

Expenses

As the pandemic lasted longer than first expected, the carrier responded to the decrease in demand by making continuous efforts of reducing capacity to minimize the operating cost, together with fixed cost restructuring by in-sourcing operations instead of outsourcing, reducing IT expenditure and reducing personnel cost, including executive level salaries and cutting bonus pay for employees.

As a result, the fixed cost reduction reached approximately 135 billion yen compared to the initial plan. Fixed costs were reduced by an additional 15 billion yen from the approximate 120 billion yen reduction announced in the third quarter results. In addition, due to the early retirement of Boeing 777 aircraft used for domestic routes, JAL incurred approximately 20 billion yen in aircraft retirement costs, resulting in an actual fixed cost of 585.1 billion yen, down approximately 115 billion yen from the initial forecast and 55.7 billion yen from the previous year

Variable costs were steadily reduced by 368.0 billion yen, or about 41% of the total revenue decline.

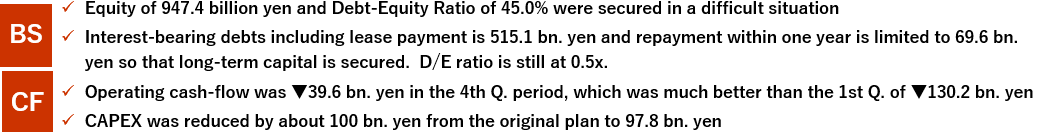

(3) Summary of Consolidated Statement of Financial Position and Cash Flow

|

Balance Sheet |

End of FY2020 |

End of March 2021 |

Diff. |

|

Total Assets |

1,982.2 |

2,107.2 |

+125 |

|

Cash and Deposits |

329.1 |

408.3 |

+79.1 |

|

Balance of Interest -bearing Debt |

277.4 |

515.1 |

+237.7 |

|

Repayment within one year |

38.6 |

69.6 |

+31 |

|

Shareholders’ Equity |

1,014.2 |

947.4 |

▲66.8 |

|

Shareholders’ Equity Ratio (%) (1) |

51.2 |

45.0 |

▲6.2pt |

|

D/E Ratio(x) (2) |

0.3x |

0.5x |

+0.3x |

(1) Shareholders’ Equity Ratio=Equity ratio attributable to owners of the parent

(2) D/E Ratio=High disability of liens ÷ Own capital

|

Cash Flow |

End of FY2020 |

End of March 2021 |

Diff. |

|

Cash Flow from Operating Activities |

80.8 |

▲219.5 |

▲300.3 |

|

Depreciation and Amortization |

162.4 |

182.4 |

+20 |

|

Cash Flow from Investing Activities |

▲233.7 |

▲91.0 |

+142.7 |

|

Capital Investment |

▲245.2 |

▲97.8 |

+147.4 |

|

Free Cash Flow |

▲152.8 |

▲310.5 |

▲157.6 |

|

Cash Flow from Financing Activities |

▲38.8 |

388.6 |

+427.4 |

|

Total Cash Flow |

▲191.6 |

78.0 |

+269.7 |

|

EBITDA(*) |

251.2 |

▲215.8 |

▲467.0 |

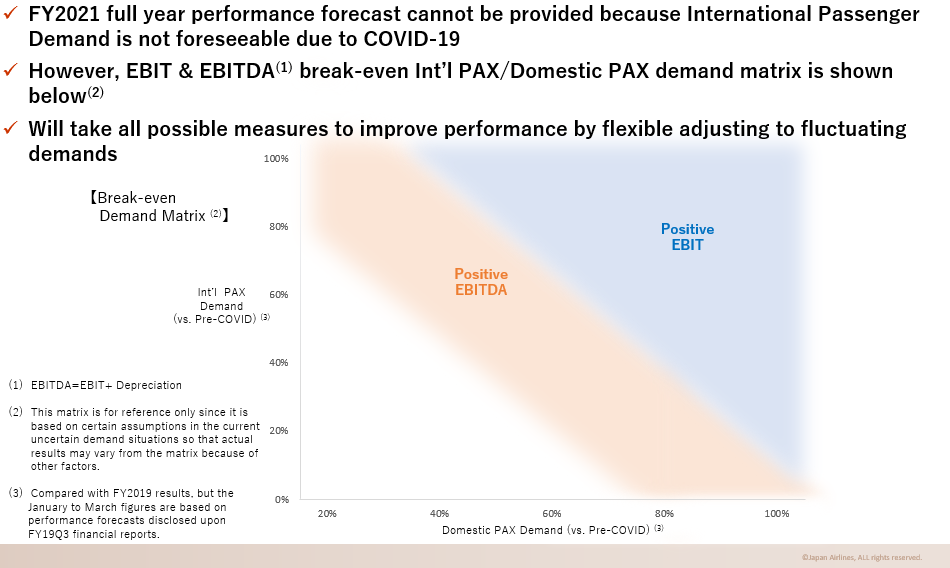

(4) Future Outlook

At present, it is difficult to foresee the recovery of demand, while the COVID-19 pandemic shows no sign of slowdown. The recovery of international and domestic passenger demand may be highly affected by the circumstances surrounding COVID-19 and by situations of border closure and travel restrictions by governments, so uncertainty on further business performances, especially for future supply plans and revenue forecast, is expected to remain. Thus, the Company is unable to provide a performance forecast for the fiscal year ending March 2022. The Company will disclose the upcoming forecast, to a certain extent, once some recovery in passenger demand returns when vaccination advances, new medicines develop and travel restrictions ease.

For reference, in the current uncertain situation, the Company will provide an EBIT and EBITDA break-even international passenger and domestic passenger demand matrix as below. This matrix is based on certain assumptions in the current uncertain demand situation so that actual results may vary from the matrix.

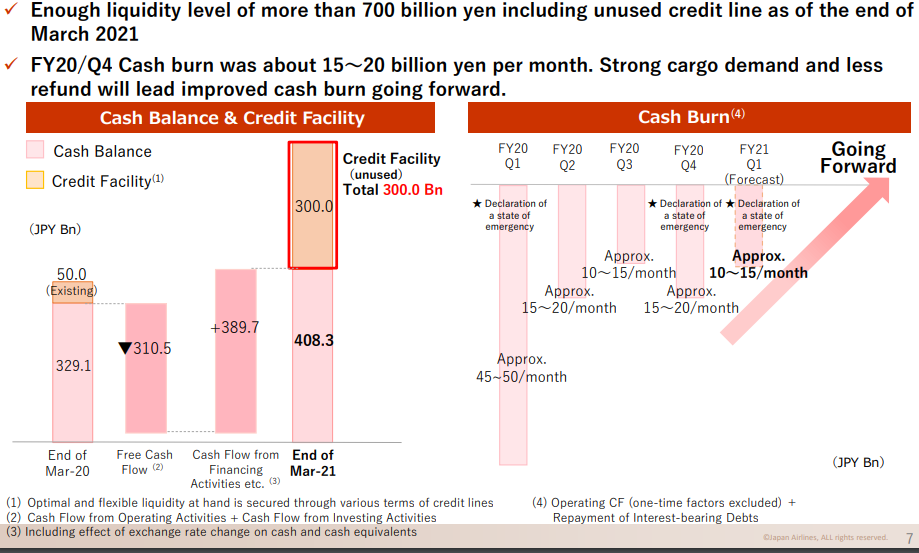

(5) Liquidity on hand and Cash Burn

As of the end of the current fiscal year, the Company has sufficient liquidity on hand to cover a total of over 700 billion yen, consisting of 408.3 billion yen in cash and deposits and 300 billion yen in unused commitment lines.

Cash burn is expected to be reduced by approximately 10-15 billion yen per month in the first quarter of the fiscal year ending March 31, 2022, due to the strong cargo business, a certain level of demand on domestic routes, and the fact that deposits associated with new ticket issuance are exceeding withdrawals from ticket refunds.

In addition, as the carrier continues to reduce costs, depending on the future recovery of domestic passenger demand, we believe that we will turn from a cash-burn situation to a cash outflow by the second quarter.

(6) Cost Management

In the current fiscal year, the Company achieved a reduction of approximately 135 billion yen in fixed costs compared to our initial forecast. In addition, the JAL Group was able to reduce real fixed costs, which are not linked to revenue or supply, to approximately 500 billion yen, a reduction of approximately 60 billion yen compared to FY2019 levels. From this fiscal year onward, the Company will focus on controlling real fixed costs, which exclude the variable portion of fixed costs that are linked to revenue and supply, as well as one-time expenses associated with business structure reform, and keep real fixed costs at the same level as FY2020 by improving efficiency and productivity during the phase of business diversification and growth.

※ Re-posted from the JAL Group Medium-Term Management Plan for Fiscal years 2021-2025(released on May7,2021)

(7) Dividends for the Current and Next Fiscal Year

Due to the prolonged impact of the global pandemic, the Company has been severely affected and the situation for the fiscal year ending March 31, 2022 remains uncertain. At this point in time, the timing of the recovery of passenger demand is uncertain and it is extremely difficult to foresee business results for the fiscal year ending March 31, 2022. As a result, the dividend forecast for the fiscal year ending March 31, 2022 has not been determined. The Company will announce the dividend forecast when the situation becomes more predictable.