Press Release

JAL Group Announces Consolidated Financial Results for The Year Ended March 31, 2023

The JAL Group today announced the consolidated financial results for the Period April 1, 2022-March 31,2023.

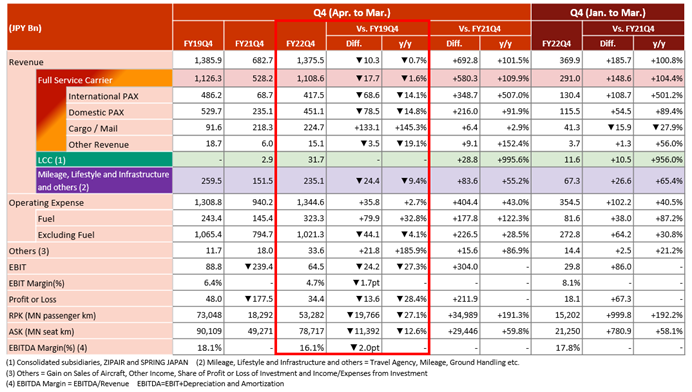

1. JAL Group Consolidated results

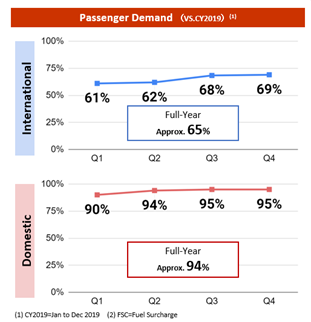

Passenger demand for both international and domestic recovered steadily as the shift toward balancing the COVID-19 pandemic’s prevention and socioeconomic activities gained momentum. The JAL Group flexibly secured its air transportation network both domestically and internationally in accordance with the situation of the COVID-19 pandemic. In addition, despite a recovery in passenger demand that took longer than expected, we made every effort to recover from the COVID-19 pandemic by working to improve earnings through comprehensive cost-cutting efforts and maximizing sales in the cargo business domain.

As a result of the above, the revenue increased by 101.5% year on year to 1 trillion 375.5 billion yen, the operating expense increased by 43.0 % year on year to 1 trillion 344.6 billion yen, EBIT was a gain of 64.5 billion yen (year on year difference +304.0 billion yen). The profit attributable to owners of the parent was 34.4 billion yen (year on year difference +211.9 billion yen ). For the first time since the fiscal year ended March 2020, the company achieved a full-year consolidated profit..

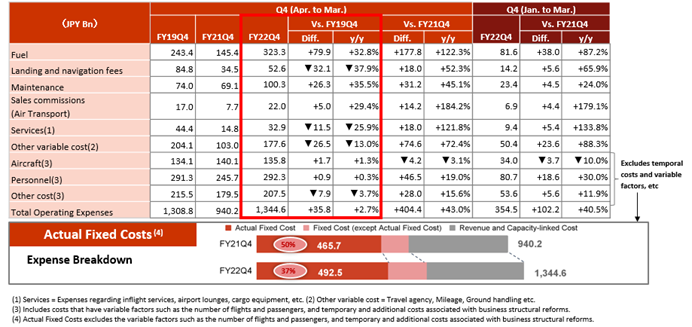

Although fuel expenses for the current fiscal year increased by 122.3% from the previous fiscal year to 323.3 billion yen due to higher fuel prices and the sharp yen depreciation, we were able to reduce actual fixed costs to 492.5 billion yen, a reduction of 7.5 billion yen from the annual target. In order to respond to the post-pandemic air transport demand, the JAL Group will continue these efforts and fulfill its social mission as a public transport company.

Major Operating Expense Items

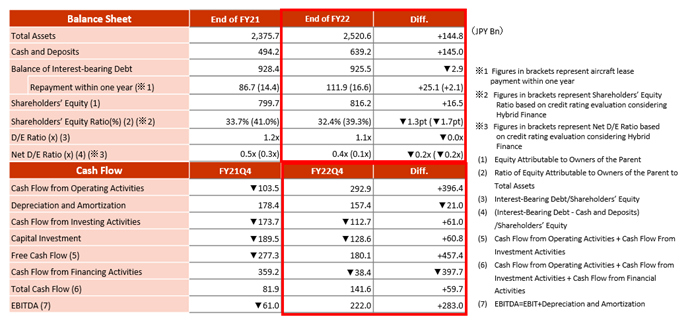

2. Summary of Consolidated Statement of Financial Position and Cash Flow

- Equity ratio is 39.3% and Net D/E ratio is x0.1 both in terms of credit rating evaluation basis, keeping a healthy level.

-Liquidity on hand at the end of March amounted to 639.2 billion yen. Together with the unused credit line of 250.0 billion yen, we secured sufficient liquidity on hand.

-As a result of a recovery trend in passenger demand, cash flow from operating activities (inflow) improved significantly to 292.9 billion yen, free cash flow was also positive at 180.1 billion yen.

3. Initiatives in each business domain

【ESG Strategy】

-In terms of SAF (Sustainable Aviation Fuel) that is one of our primary pillars toward reduced CO2 emissions, we have steadily increased procurement from overseas. In November 2022 we announced procurement with Neste OYJ, one of the world's largest manufacturers of renewable fuels, as well as agreeing on future procurement with Raven SR Inc. in January 2023, which aims to produce renewable fuels from municipal solid waste.

-We are steadily replacing our fleets with fuel-efficient aircrafts, with 21 smaller-sized aircrafts in operation being replaced with Boeing 737-8 aircrafts beginning in fiscal 2026,

-From a DEI perspective, we have promoted the development of diverse human resources and work styles, including women, global, and senior human resources. As a result of our proactive efforts in health management, we were selected as a constituent of the “2023 Certified Health & Productivity Management Outstanding Organizations” list for 2 consecutive years, and 24 JAL Group companies were selected as a constituent of the “2023 Certified Health & Productivity Management Outstanding Organizations - White 500” list. In addition, the JAL Group's Integrated Report were awarded the “E Award” at the Nikkei Integrated Report Awards 2022 hosted by Nikkei Inc., which is given to companies that have particularly outstanding environment-related statements.

-For the fourth time in the past 5 years since 2018, we were ranked 1st place in the transportation category for “Award for Excellence in Corporate Disclosure” by The Securities Analysts Association of Japan.

【Full Service Carrier business domain】

-For international passengers, the number of passengers arriving in and departing from Japan is gradually recovering especially for inbound passengers as the maximum number of entries into Japan was lifted, and drastic relaxation was conducted including the exemption of temporary visitor visas. Furthermore, we have responded flexibly to changes in the business environment, including the establishment of flight schedules that offer convenient transit at Narita Airport, aimed at capturing transit demand particularly between Asia and North America, where demand is recovering quickly. Going forward, a strong recovery in demand is expected including the relaxation of border measures upon entry into Japan.

-For domestic passengers, demand had recovered steadily especially for tourists, especially through positive effects of the nationwide travel support program. In response to the increase in passengers, we provided sufficient capacity, including the establishment of additional flights and aircraft upscale. As a result, many passengers boarded our flight especially during the high-demand period such as Golden Week, New Year’s Holidays and Spring Holidays, which saw a recovery of passenger numbers to approximately 90% of 2019 levels.

-In the cargo business, while total air cargo demand began to decline after the summer, cargo demand for our company continued to be strong, especially between Asia and North America. We captured as much demand as possible through cargo flights utilizing passenger aircrafts and cargo flights from other companies. Although unit price is on a downward trend, it remains at a higher level than pre-pandemic levels. As a result, revenue is growing significantly compared to pre-pandemic levels.

【LCC business domain】

-ZIPAIR has seen steady progress in business operations, achieving early positive profits through rising customer recognition and steady increase in its load factors, with flights frequently fully-booked especially during periods of high demand. In addition, ZIPAIR started its service on the San Jose route in December 2022 and is aiming to start service on the San Francisco route in June 2023 and Manila route in July 2023. It has been steadily accumulating results, in line with the recovery of international passenger demand.

-SPRING JAPAN which targets China routes, worked to improve its profitability by temporarily increasing the number of domestic flights to make effective use of its resources, as demand in China was not expected to recover in the near term due to the continuation of strict entry regulations. Going forward, a strong recovery in demand is expected with the easing of China's border restrictions.

【Non-Aviation Business Domain】

-The JAL Group launched a new partnership program with one of the largest point service providers in Japan, Rakuten Point. Moreover, JAL Pay, a smartphone payment service, was launched and is now available at supported stores and in-flight sales. We are also offering mileage-related services for a variety of daily situations other than boarding an aircraft.

- JALUX, which became a consolidated subsidiary in the fiscal year 2021, has been working to develop regional areas and create more associated demand centering on the JAL Group’s destinations, through the “JAL hometown tax reduction program” site. Moreover, JAL Sales has decided on a merger with Japan Airlines in October 2022 and will strengthen its efforts to solve issues faced by regions and customers by providing sales solutions through utilizing assets across our group, not limited to sales of air tickets.

- The JAL Group was also selected to operate “AIRTAXI” at the EXPO 2025 Osaka, Kansai. We will operate “AIRTAXI” safely and securely in EXPO 2025 Osaka, Kansai, offering passengers the opportunity to actually board the vehicles.

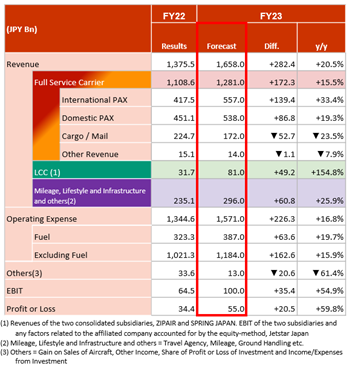

4. Future Outlook

The COVID-19 pandemic has had a profound impact on many industries including aviation, and has brought profound changes that have overturned social and economic assumptions. Although passenger demand is recovering, the speed of recovery, especially for flights from Japan, is still lacking due to the impact of the Russia-Ukraine situation, currency fluctuations, and soaring fuel prices. However, the JAL Group has overcome the unprecedented situation of a sharp and significant decline in demand and is firmly in place to fully capture the recovering demand, including resuming the recruitment of human resources toward medium-to long-term growth.

The JAL Group will simultaneously restructure its financial position and strive toward sustainable growth, in line with the “JAL Group Medium-Term Management Plan FY 2021-2025 Rolling Plan 2023”, aiming to become “the most loved, and number one airline group of choice in the world” and take on the challenge of providing comfortable air travel to all of our customers.

As a result of the above, by establishing a stable profit structure in the post-pandemic environment, the forecasted consolidated financial results for the fiscal year ending March 2024 are revenue of 1 trillion 658 billion yen, EBIT of 100 billion yen and net income attributable to owners of the parent of 55 billion yen.

Consolidated financial results forecast for the fiscal year ending March 2024

5. Dividend for Fiscal 2022 and Fiscal 2023

Since the spread of the COVID-19 pandemic, the JAL Group has not provided dividends for the fiscal year ending March 31, 2021 and the fiscal year ending March 31, 2022 as it was necessary to place the highest priority on securing liquidity on hand and strengthening our financial position. However, the JAL Group plans to pay its year-end dividend for the fiscal year ended March 31, 2023, as cash flow is steadily recovering, positive profitability is achieved for the full fiscal year, and as air transport demand is expected to make a steady recovery toward the next fiscal year.

We plan to increase dividends to 25 yen per share as results for the fiscal year ended March 31, 2023 exceeded earnings forecast levels, which were announced on February 2, 2023. We would like to express our deep appreciation to our shareholders for their continued support during the pandemic.

We forecast a dividend of 40 yen per share for the fiscal year ending March 2024, including an interim dividend of 20 yen per share, as cash flow is steadily recovering, positive profitability is expected for the full fiscal year, and as air transport demand is expected to make a steady recovery toward the next fiscal year. Going forward, we will strive to achieve our basic policy of a continuous and stable shareholder return, that is in line with our business recovery.