Press Release

JAL Group Announces Consolidated Financial Results for First Quarter of Fiscal Year 2023

Summary

- In the first quarter, both EBIT and net profit turned positive for the first time in four years.

- Increased revenue and profits were achieved compared to the first quarter of the fiscal year 2019, by steadily capturing the recovering passenger demand.

The JAL Group today announced the consolidated financial results for First Quarter of Fiscal Year 2023.

1. JAL Group Consolidated Results for the Period April 1, 2023 - June 30, 2023

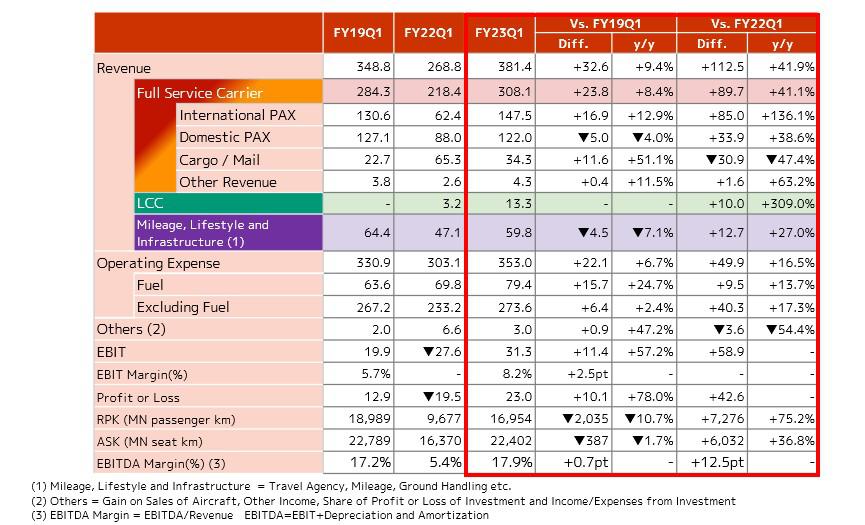

The revenue for the first quarter period increased by 41.9% year on year to 381.4 billion yen, the operating expense increased by 16.5% year on year to 353.0 billion yen. As a result, EBIT was a profit of 31.3 billion yen (an increase of 58.9 billion yen year on year), and the profit attributable to owners of the parent was 23.0 billion yen (an increase of 42.6 billion yen year on year). Fuel expenses for the period amounted to 79.4 billion yen, increasing by 13.7% year on year, due to an increase in the amount of fuel loaded as demand recovered, despite a decline in fuel market conditions. Overall, the increase in operating expenses was limited to 16.5% year on year, which is below the increase in production volume (36.8% year on year), achieved through robust cost control. Moving forward, the JAL Group will strive to further increase profits and achieve its goals.

Details of the consolidated financial results (Including LCC)

2. Summary of the JAL Group’s operating results for the first quarter by business domain

Full Service Carrier Business Domain

- The demand for international passengers is expected to continue recovering steadily due to the end of border restrictions in Japan and with both overseas and domestic travel demand showing signs of improvement. Passenger numbers have increased 2.2 times year on year, and revenue has grown by 2.4 times. The outlook for future recovery remains promising.

- For domestic passengers, supply at pre-pandemic levels has already been provided, as restrictions on movements have been lifted, and socioeconomic activities have resumed. Passenger numbers have increased 1.4 times, and revenue has grown by 1.4 times year on year.

- In the cargo business, as the tightness of global supply and demand has been resolved, the focus has been on the transportation of high value-added goods, such as pharmaceuticals, through high-quality transportation services. JAL aims to maximize volume, particularly between Asia and North America, by utilizing both their own resources and those of other companies. Although revenues declined by 53.7% year on year, revenue higher than pre-pandemic levels has been maintained.

LCC Business Domain

ZIPAIR started servicing the San Francisco route, its third U.S. West Coast route in June, capturing demand mainly from strong overseas demand and steadily improving seat utilization, resulting in 4.6 times increase in passenger numbers and 5.7 times increase in revenue year on year.

Mileage, Infrastructure and Others Business Domain

The overall year on year increase was 27% due to an increase in the number of miles issued, an increase in the number of visits to airport stores, an increase in commerce sales following the opening of the JAL Mall, and an increase in aircraft handling revenues following the return of international flights.

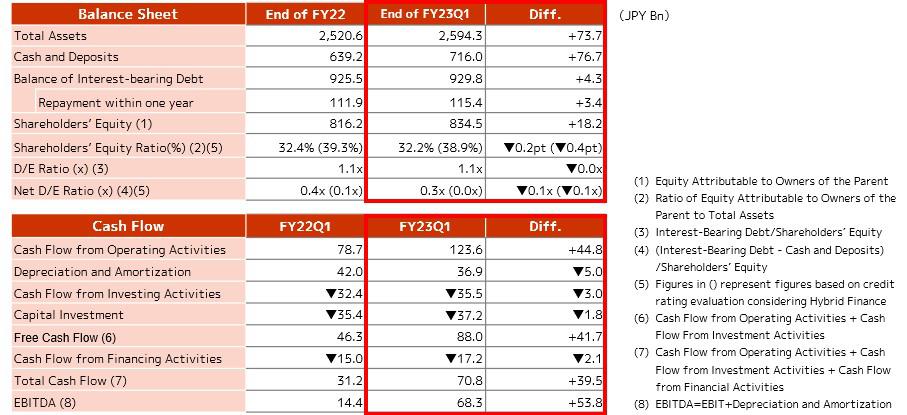

3. Summary of Consolidated Statement of Financial Position and Cash Flow

- Equity ratio is 38.9% and Net D/E ratio is x0.0 both in terms of credit rating evaluation basis, keeping a healthy level.

- Liquidity at hand was maintained at a sufficient amount of 716.0 billion yen at the end of this first quarter, as well as the unused credit line of 150.0 billion yen. While the credit line was increased during the pandemic, the credit line amount was reduced on June 30 upon reflecting the improvement performance and cash flow.

- As a result of a recovery trend in passenger demand, cash flow from operating activities (inflow) in the first quarter improved significantly to 123.6 billion yen (increase of 44.8 billion yen year on year). Free cash flow was also positive at 88.0 billion yen.

4. First quarter and recent initiatives

ESG Strategy

- To achieve carbon neutrality, JAL has signed an agreement in June with Shell Aviation, Shell's aviation fuel division, to procure SAF (Sustainable Aviation Fuel) at Los Angeles International Airport from 2025. As a result, JAL’s goal of “replacing 1% of all fuel on board with SAF in FY2025” is expected to be achieved. In the same month, our second transition bond to facilitate the smooth implementation of fuel-efficient aircraft was issued.

- In terms of human capital management, in April we welcomed approximately 2,000 new employees for the first time in 3 years and resumed mid-career recruitment, in view of the future shortage of human resources, while also keeping the total number of employees at pre-pandemic levels. Going forward, we will promote the diversity of human resources and increased productivity, and enhance human capital management that considers human resources as capital to improve our corporate value.

Full Service Carrier Business Domain

- As part of JAL's new Chinese route from Haneda, a nonstop service on the Haneda = Dalian route has started from July 2023. In addition, JAL has announced a nonstop service on the Haneda = Doha route starting in the summer schedule of 2024, to open a new gateway to Europe, Africa, and South America.

- From the winter schedule of 2023, the new flagship for international flights, the Airbus A350-1000 will be launched on the Haneda = New York route. This will enable a reduction of fuel consumption by about 15-25% compared to current aircraft, along with the introduction of new cabin specifications and services to enhance customer satisfaction.

LCC Business Domain

- ZIPAIR - a LCC for medium to long-haul international flights, started service on the San Francisco route in June

as well as the Manila route in July. It has performed strongly with operating profit margins close to 15%, achieved

through high rates of aircraft utilization and increased seat number, and is showing steady growth.

- The three LCCs with different characteristics, including SPRING JAPAN which targets routes in China, and Jetstar Japan Co., Ltd. (Jetstar Japan) which mainly operates domestic flights, will strive to build a network based at Narita Airport, aiming to create a new flow of people, including young people and families.

Mileage, Infrastructure and Others Business Domain

In May, an online shopping mall (JAL Mall) was opened to improve the mileage’s ease of use by developing special products through synergies with JALUX Inc. (JALUX). Currently, the number of attracted tenants stands at 29 stores, and it is expected to expand to 55 stores by October. In this business area, we will continue to create connections between people and goods to generate new sources of revenue and new air transport demand, finally leading to the expansion of revenues in the airline business.

5. Forecast of Consolidated Financial Results

There are no changes to the forecast for full-year consolidated financial results and the dividend forecast announced in “Consolidated Financial Results for the year Ended March 31, 2023" dated May 2, 2023.