Press Release

JAL Group Announces Consolidated Financial Results for Second Quarter of Fiscal Year 2023

Summary

- Revenue, EBIT, and net profit have all exceeded FY19 pre-pandemic levels.

- By steadily capturing the recovering passenger demand in the second half of the fiscal year,

an upward revision of the forecast for the consolidated full-year performance has been made.

- The annual dividend forecast has been increased from 40 yen to 60 yen per share.

The JAL Group today announced the consolidated financial results for the six month ended September 30, 2023.

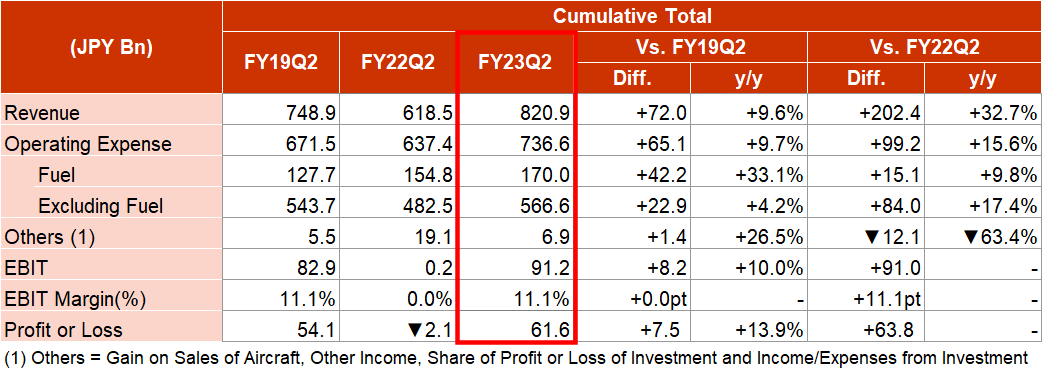

1. JAL Group Consolidated Results for the Period April 1, 2023, to September 30, 2023

In the second quarter, passenger demand exceeded initial expectations, following the trend from the first quarter, with strong inbound international passenger demand and signs of recovery in outbound business demand from Japan. Additionally, domestic passenger demand has already recovered to pre-pandemic levels, especially for tourism demand. These factors indicate an overall steady recovery in passenger demand.

On the other hand, the surrounding environment is becoming increasingly severe due to such factors as the weak yen, high fuel prices, and unstable global conditions.

In the above business environment, both revenue, EBIT, and net profit increased in the year on year comparison as well as compared to the same period of fiscal year 2019.

2. Summary of the JAL Group’s operating results for the second quarter by business domain

Full Service Carrier Business Domain

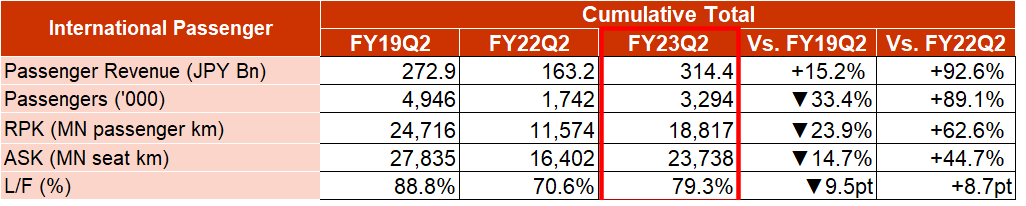

■International Passenger Business:

The recovering demand has been effectively captured, resulting in passenger numbers steadily recovering to approximately 67% compared to 2019, and an increase in passenger revenue to approximately 115%.

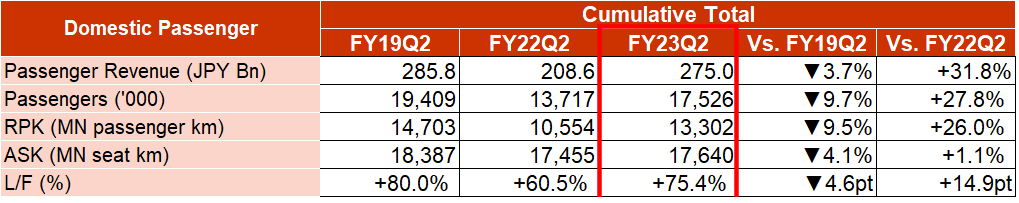

■Domestic Passenger Business:

By actively promoting demand acquisition through high competitiveness and flexible pricing strategies, resulting in passenger numbers steadily recovering to approximately 90% compared to 2019, and passenger revenue reaching approximately 96%.

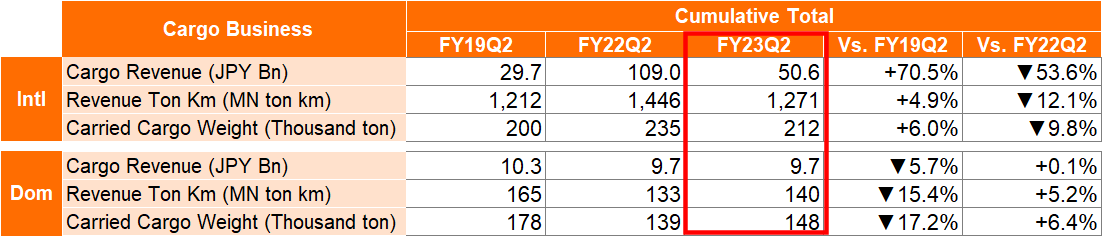

■ Cargo and Mail Business:

In the international cargo business, the transportation volume reached approximately 106% compared to 2019, while the unit price increased to approximately 160% and the revenue reached approximately 170%, despite the challenging market environment.

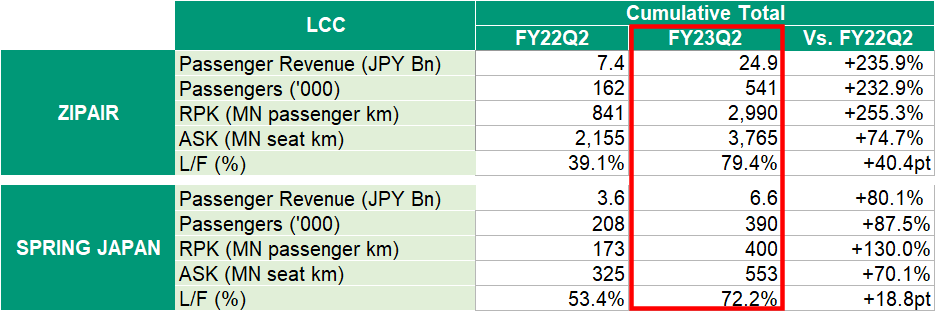

LCC Business Domain

ZIPAIR started service on the San Francisco route in June as well as the Manila route in July, expanding the number of destinations to eight, mainly in North America and Asia. In September, the cumulative number of passengers exceeded one million, with passenger numbers reaching approximately 3.3 times compared to the previous year.

Furthermore, Spring Japan achieved a year on year increase in passenger numbers by approximately 1.9 times, and since July, it has been operating three daily flights to China.

As a result of these initiatives, the LCC business domain achieved positive profitability, with an EBIT of 2.7 billion yen.

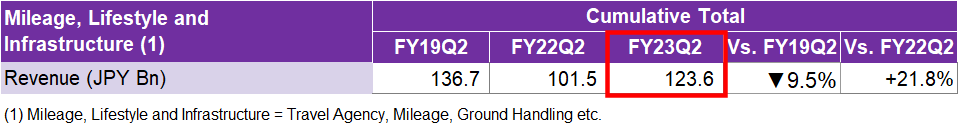

Mileage, Infrastructure and Others Business Domain

Revenue increased by approximately 1.2 times compared to the previous year. Moreover, the use of "Award Ticket PLUS" which allows customers to book award ticket reservations with miles even during busy periods, has been increasing since its launch for domestic flights in April. Efforts will continue to be made to enhance the ease and convenience of earning and using miles. In addition, focus will be placed on ensuring adequate capability of airport ground handling services and expanding the number of airport handling contracts with overseas airlines.

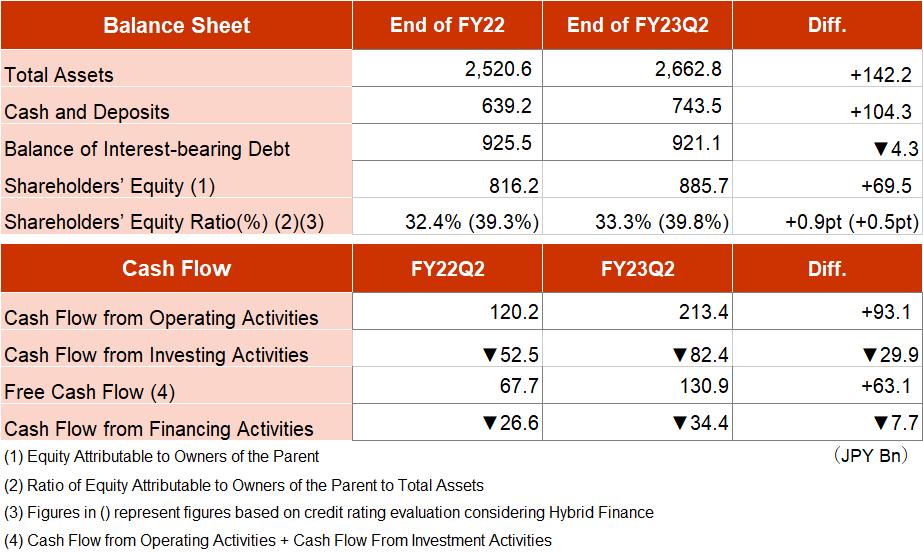

3. Summary of Consolidated Statement of Financial Position and Cash Flow

4. Recent initiatives

Air Transport Related Business Domain

- In September, JAL Group received the "WORLD CLASS" award from APEX (Airline Passenger Experience Association) for the third consecutive year, in recognition of its sustainability initiatives and service quality at the world's highest level.

- JAL will continue to work with everyone concerned to commercialize, promote, and expand the use of SAF (Sustainable Aviation Fuel) in Japan, which is crucial to achieving its goal of “replacing 10% of all fuel on board with SAF by 2030”. During the UN SDG Summit, JL6 flights were operated as "Sustainable Challenge Flights" on the Haneda - New York route, from September 14th to 20th. On these flights, approximately 11% of the total fuel load was replaced with SAF, and carbon credits were used to achieve net zero CO2 emissions.

Efforts were made to raise awareness and foster momentum towards achieving carbon neutrality by 2050.

Human Capital Management

- To support the autonomous career development of employees, JAL is focusing on reskilling and fostering a

culture of self-directed learning. As part of this initiative, employees will receive DX (Digital Transformation) education starting in November. The aim is to leverage digital technologies and new tools to enhance customer experience value, improve employee productivity, and expand business opportunities.

- This fiscal year, a base salary increase has been implemented in Japan for the first time in four years. In addition, initiatives will be carried out to promote human capital management that leads to higher corporate value by considering human resources as capital, such as by raising wages for employees working overseas and reviewing outsourcing fees to improve working conditions.

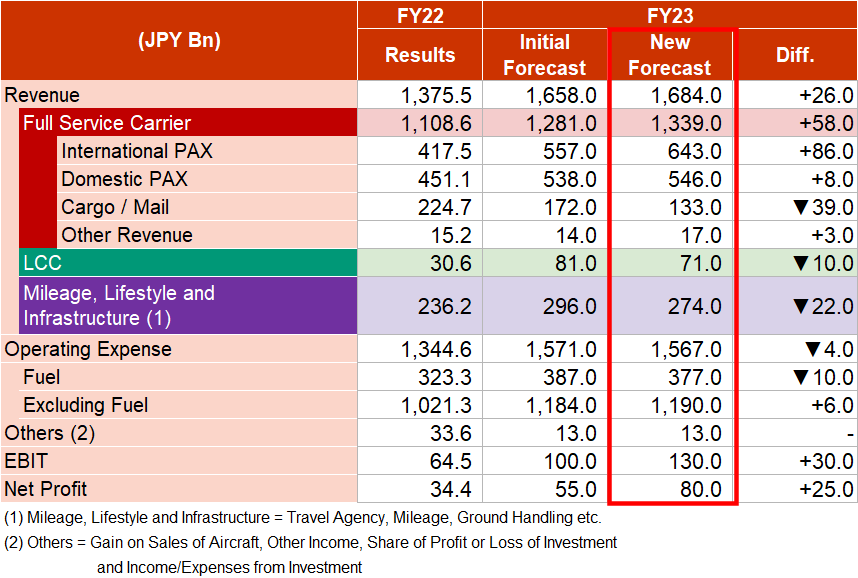

5. Forecast of Consolidated Financial Results for the Fiscal Year ending March 2024

To reflect the latest trends in air transport demand, the following revisions have been made to the initial consolidated financial results forecast for this fiscal year.

In calculating the forecast, the market assumption has been adjusted to a dollar-yen exchange rate of 145 yen and the market price of Singapore kerosene, an indicator of aviation fuel costs, to US $120 per barrel.

6. Dividend for the current period

In light of the revision of the consolidated financial results forecast for the full fiscal year, the annual dividend forecast has been increased from 40 yen to 60 yen per share. Of this amount, the interim dividend has been set as 30 yen per share.

The JAL Group is dedicated to achieving the realization of continuous and stable shareholder returns as part of its long-standing fundamental policy.

About JAL

Japan Airlines (JAL), Japan’s first private aviation company, was established in 1951 and is a member of the oneworld® Alliance. The airline operates a fleet of 224 aircraft and began renewing its international flagship aircraft Airbus A350-1000 starting 2023 Winter Schedule. Together with other JAL Group and partner airlines, JAL offers an extensive domestic and international network that serves 376 airports across 64 countries/regions. The airline has received numerous accolades for its exceptional service, including being recognized as a certified 5-Star Airline by Skytrax and being awarded the prestigious "World Class" Airline title by APEX, the Airline Passenger Experience Association. JAL takes great pride in its on-time performance and is regarded as one of the most punctual airlines globally. The airline is dedicated to ensuring the highest standards of flight safety and overall service quality, striving to be the most preferred airline by customers worldwide. The JAL Group recognizes that action to address climate change is a particularly important issue for the sustainability of society, and in June 2020, the group announced its commitment to achieve net zero carbon emissions by 2050.

For details and to learn more, visit JAL's official website at https://www.jal.com/en/.