Press Release

JAL Group Announces Consolidated Financial Results for Fiscal Year 2023

Summary

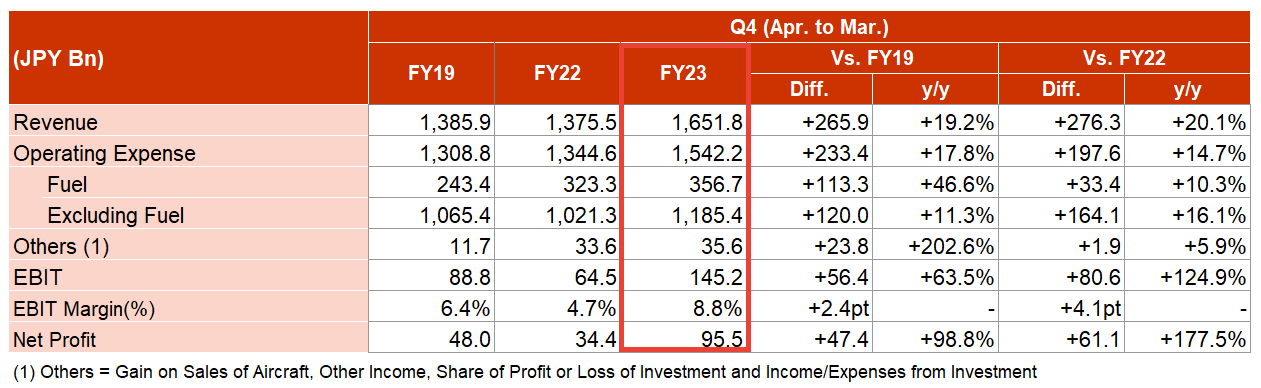

- Post-COVID-19 demand recovery led to significant increases in revenue, reaching JPY 1 trillion 651.8 billion (increase of 20% year-on-year) and EBIT of JPY 145.2 billion (increase of 120% year-on-year), with EBIT further revised upwards by JPY 5.2 billion.

- As a result, the year-end dividend was further increased to JPY 45 per share, making the annual dividend JPY 75 per share (with a dividend payout ratio of 34.3%).

- For the current fiscal year, the aim is for further growth with revenue targeted at JPY 1 trillion 930.0 billion and EBIT at JPY 170.0 billion, focusing on increasing revenue in both aviation and non-aviation businesses and improving productivity through investment in human resources.

The JAL Group today announced the consolidated financial results for FY2023 ending March 2024 (April 1, 2023, to March 31, 2024).

1. JAL Group Consolidated Results for the Period April 1, 2023, to March 31, 2024

For the fiscal year April 1, 2023, to March 31, 2024, the company significantly exceeded the previous year's performance in revenue and profit levels in the post-COVID-19 environment, capturing the demand following the resumption of free travel. International passengers saw an increase, with the number of visitors to Japan exceeding pre-pandemic levels for the first time in October, allowing the company to capture strong inbound demand. This resulted in passenger numbers being approximately 1.5 times of the previous year, with ZIPAIR achieving an increase of 2.3 times. For domestic passengers, efforts to stimulate demand throughout the year, such as promotional campaigns during off-peak seasons, resulted in passenger numbers reaching approximately 1.2 times of the previous year, contributing to an overall recovery in passenger numbers.

In addition to increased supply from the recovery of services, due to factors such as the depreciation of the yen, global inflation, and investments in human capital aimed at securing a stable workforce, costs rose by approximately 15%. However, efforts for cost control and improved yield led to an enhancement in profitability, resulting in an increase in revenue of approximately 20%. As a result, both EBIT and net profit for the current period significantly exceeded previous year’s levels.

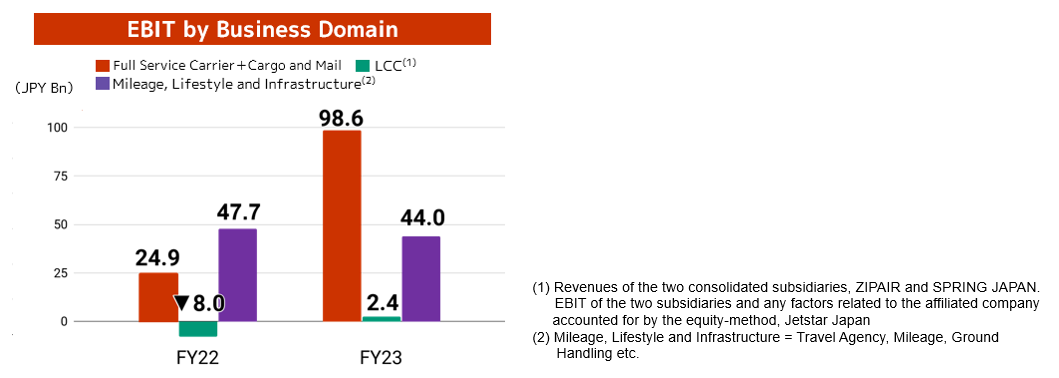

2. Summary of the JAL Group’s operating results for Fiscal Year 2023 by business domain

Full Service Carrier Business Domain

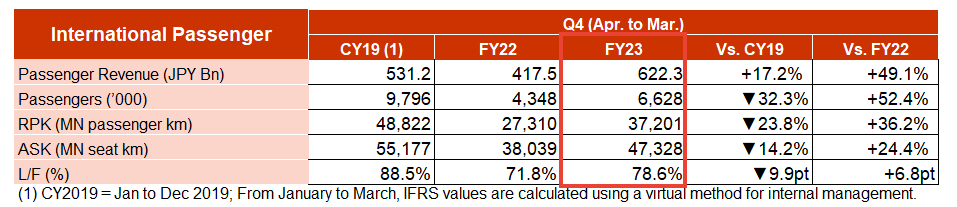

■ International Passenger Business:

Passenger numbers and revenue both increased to approximately 1.5 times year-on-year. Revenue per passenger was maintained at a high level as expected and is anticipated to continue at such a level after April.

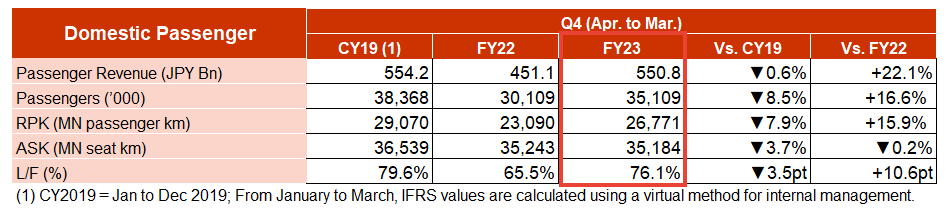

■ Domestic Passenger Business:

Both passenger numbers and revenue per passenger increased compared to the previous year, with passenger revenue reaching approximately 1.2 times year-on-year. Revenue per passenger was maintained at a higher-than-expected level, and is expected to continue to rise after April.

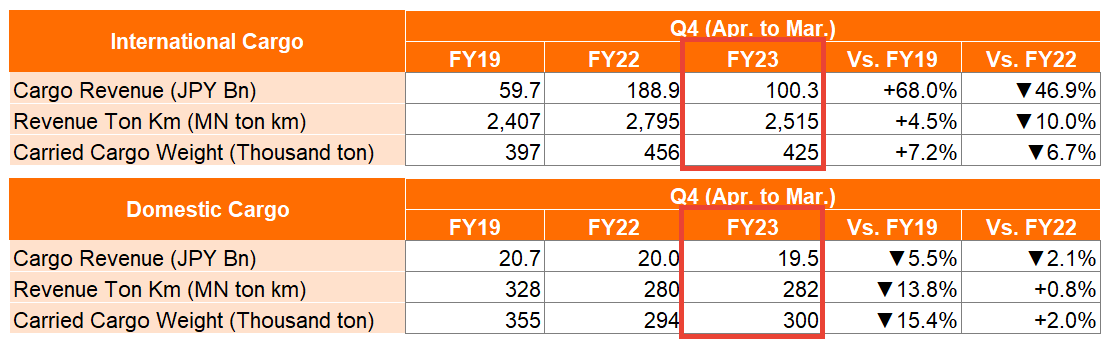

■ Cargo and Mail Business:

The international cargo business, despite a declining trend in air cargo demand following the ease of the pandemic, captured robust e-commerce demand and focused on maximizing the volume of high value-added cargo, the weight carried increased by about 7%, and revenue increased about 1.7 times compared to FY2019.

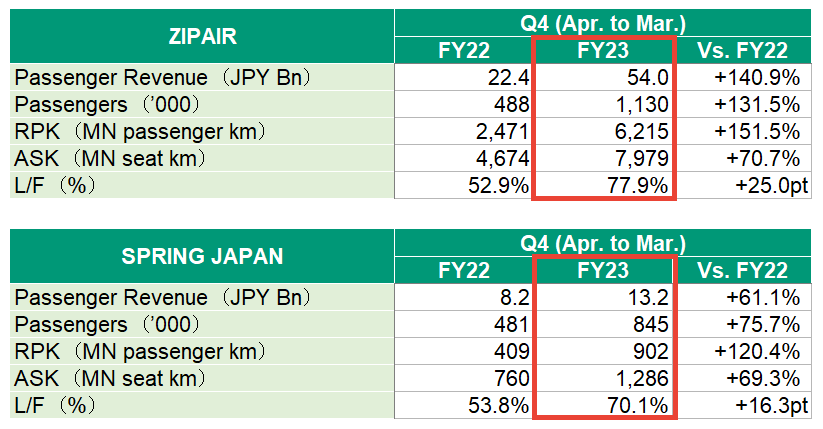

LCC Business Domain

The LCC business domain’s EBIT for FY2023 turned profitable. ZIPAIR started its new service to Vancouver in March 2024, expanding its network to 9 locations mainly in North America and Asia. Currently operating with 8 aircraft, ZIPAIR plans to expand its fleet to 10 by FY25, actively expanding its capacity.

SPRING JAPAN operates 4 international and 2 domestic routes from Narita, and will capture future inbound demand. The LCC business aims to create new flows of people, including younger passengers and families.

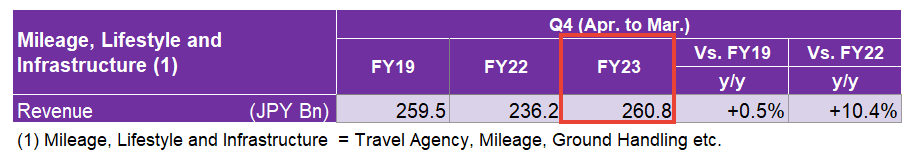

Mileage, Infrastructure and Others Business Domain

Increased revenue from JALUX and an increase in the number of ground handling contracts for foreign airlines contributed to an increase in revenue of about 10% year-on-year. The number of miles issued is steadily increasing, and the Mileage, Lifestyle and Infrastructure business area is steadily recording profits. Continued efforts will be made to further increase profits.

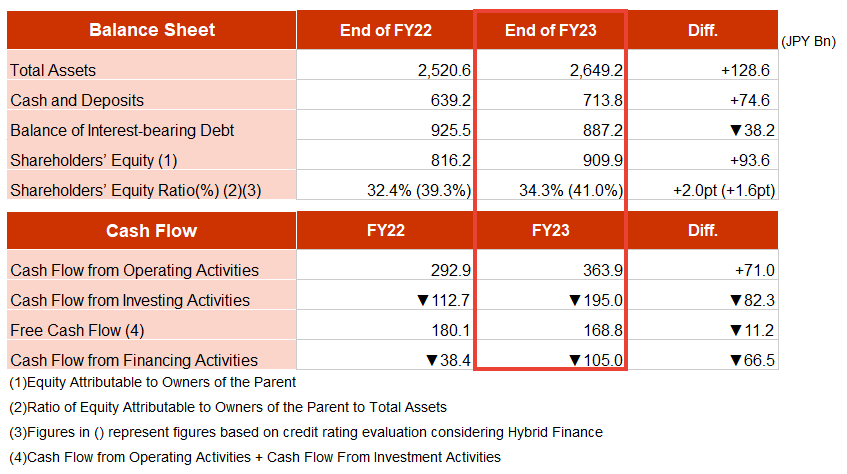

3. Summary of Consolidated Statement of Financial Position and Cash Flow

4. Recent initiatives

Air Transport Related Business Domain

- From January 24, 2024, the Airbus A350-1000 was introduced on the Haneda-New York route, followed by the Haneda-Dallas Fort Worth route from April 17, and will be sequentially introduced to other routes such as Haneda-London. In addition to promoting decarbonization, the JAL Group will provide tailored journeys to customers with even greater comfort, enhancing product and service offerings.

- On March 31, 2024, the first direct flight from Japan to the Middle East was launched on the Haneda-Doha route, aiming to strengthen the network as a new gateway to Europe, Africa, and South America.

- In the cargo business, operations began for the Boeing 767-300ER freighter from February 19, 2024, and the A321-P2F freighter in collaboration with the Yamato Group from April 11, 2024. The company aims to build a stable transportation network both internationally and domestically, capturing the robust e-commerce demand and high value-added cargo such as pharmaceuticals and perishables for international cargo, and addressing social issues such as the “2024 issue” for domestic cargo, while achieving sustainable growth in the air cargo business and contributing to the society and our customers.

Mileage, Infrastructure and Others Business Domain

- The JAL Global Club was renewed in January 2024, and the "JAL Life Status Program" was launched, which allows users to earn status points throughout their lifetime, through boarding JAL flights and also through usage of services in daily life, not limited to single-year flight achievements. In the retail business, airport stores at 24 domestic airports have been renamed to "JAL PLAZA," offering a wide range of products and services, including JAL’s original goods, and the "JAL Mall" e-commerce site, which opened in May, now hosts 90 shops.

Airport Service

- "JAL SMART AIRPORT" was newly introduced at Nagoya (Chubu) Airport from April 28, 2024, in addition to the existing deployment at five domestic airports (New Chitose, Haneda, Osaka/Itami, Fukuoka, Naha), and is scheduled to be sequentially introduced at Oita, Kumamoto, and Kagoshima Airports by May, making it available at nine airports domestically.

- "JAL SMART SECURITY" has been fully introduced at Naha Airport following Haneda Airport from March 2024, offering a seamless and more advanced security check and providing a stress-free start to the journey.

Ground Handling

- From April 1, 2024, in collaboration with All Nippon Airways Co., Ltd., the operation of a system that mutually recognizes work qualifications in the ground handling field began at ten domestic airports (Rishiri, Nakashibetsu, Hakodate, Akita, Sendai, Niigata, Okayama, Tokushima, Kochi, Kagoshima), where both companies use the same subcontractors.

5. Dividend for the Current and Next Fiscal Year

For the fiscal year ending March 2024, the year-end dividend is increased to JPY 45 per share and the annual dividend to JPY 75 per share, as earnings results exceeded the consolidated financial results forecast for the full year announced on March 21, 2024.

For the fiscal year ending March 2025, an annual dividend of JPY 80 per share is forecasted, including an interim dividend of JPY 40 per share, as outlined in the forecast of consolidated financial results announced on March 21, 2024. This is due to the expected increase in both revenue and profit, primarily from a further rise in revenue per domestic passenger and an increase in international passenger revenue from a recovery in outbound demand from Japan. Efforts will be made to achieve the basic policy of a continuous and stable shareholder return, in line with business recovery.

6. Future Outlook

The JAL group announced the "JAL Group Medium-Term Management Plan Rolling Plan 2024" on March 21, 2024, for the fiscal years 2021-2025. Facing new challenges common to all of society, such as unstable global situations, global inflation, and a shortage of human resources, while considering changes in the management environment, efforts are directed towards achieving further growth through business model reforms in the fiscal year ending March 2025.

For the fiscal year ending March 2025, based on the business environment outlined in the same medium-term management plan, it is expected that the supply-demand balance for international passengers will remain tight. The consolidated revenue is forecasted at JPY 1 trillion 930.0 billion, EBIT at JPY 170.0 billion, and net profit at JPY 100.0 billion, as outlined in the forecast of consolidated financial results announced on March 21, 2024.

About JAL

Japan Airlines (JAL), Japan’s first private aviation company, was established in 1951 and is a member of the oneworld® Alliance. The airline operates a fleet of 227 aircraft (as of March, 2024) and began renewing its international long-haul aircraft with the Airbus A350-1000 starting 2023 Winter Schedule. Together with other JAL Group and partner airlines, JAL offers an extensive domestic and international network that serves 376 airports across 64 countries/regions. The airline has received numerous accolades for its exceptional service, including being recognized as a certified 5-Star Airline by Skytrax and being awarded the prestigious "World Class" Airline title by APEX, the Airline Passenger Experience Association. JAL takes great pride in its on-time performance and is regarded as one of the most punctual airlines globally. The airline is dedicated to ensuring the highest standards of flight safety and overall service quality, striving to be the most preferred airline by customers worldwide. The JAL Group recognizes that action to address climate change is a particularly important issue for the sustainability of society, and in June 2020, the group announced its commitment to achieve net zero carbon emissions by 2050.

For details and to learn more, visit JAL's official website at https://www.jal.com/en/.

For media queries, please contact mediarelations.hdq@jal.com