Press Release

JAL Group Announces Consolidated Financial Results for the Second Quarter of Fiscal Year Ending March 2025

Summary

- Revenues of both aviation and non-aviation businesses exceeded the previous year, with total revenue reaching JPY 901.8 billion (increase of 10% year-on-year).

- EBIT decreased by 6% year-on-year to JPY 85.6 billion. However, for the second quarter alone, EBIT increased by 6% year-on-year to JPY 63.5 billion.

- There are no changes to the full-year forecast of JPY 170.0 billion in EBIT, JPY 100.0 billion in net profit, and an annual dividend forecast of JPY 80 per share. The interim dividend has been decided at JPY 40 per share.

Tokyo, JAPAN - The JAL Group today announced the consolidated financial results for the second quarter of

the fiscal year ending March 2025.

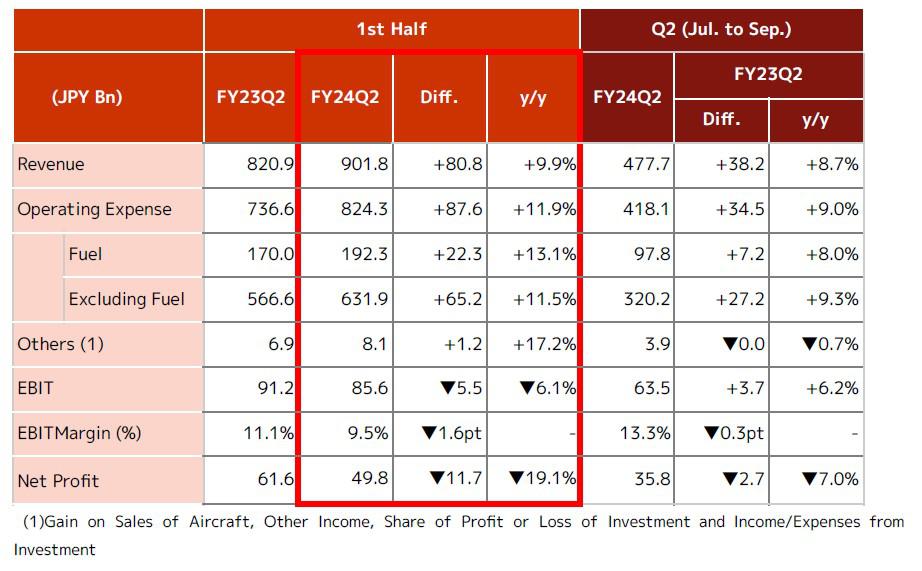

1. JAL Group Consolidated Financial Results

For the second quarter, revenue increased by 9.9% year-on-year to JPY 901.8 billion. Operating expenses

increased by 11.9% mainly due to higher fuel costs caused by the weaker Japanese yen and increased costs

linked to revenue increase.

As a result, EBIT was JPY 85.6 billion, a 6.1% decrease year-on-year, and net profit was JPY 49.8 billion, a

19.1% decrease year-on-year.

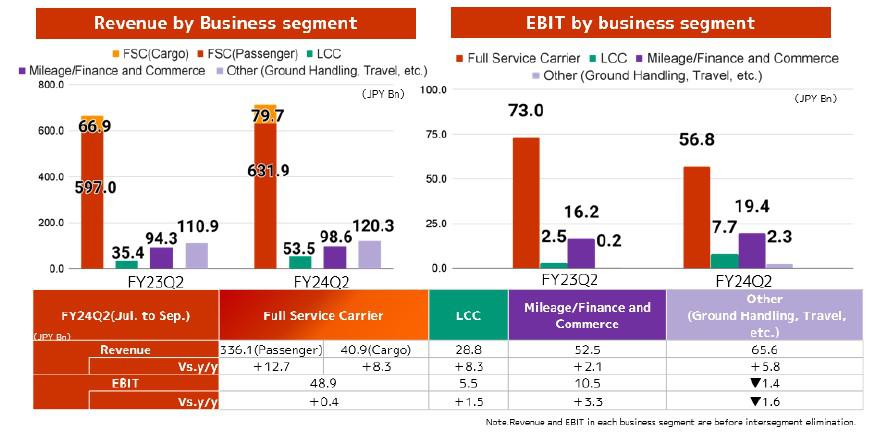

2. Performance by business segment

Revenues from both Full-service carriers and LCCs, as well as non-aviation businesses such as

Mileage/Finance and Commerce and Others, exceeded those of the previous year. Additionally, due to

increased profits in non-aviation businesses driven by business model reforms, the second quarter profits

alone saw an increase, compared to the previous year.

Full Service Carrier Business

Revenue increased by 7.2% year-on-year to JPY 711.6 billion, as the recovering demand in international, domestic, and cargo segments were successfully captured. However, due to increased investment in human capital for future business expansion, EBIT decreased by 22.2% year-on-year to JPY 56.8 billion.

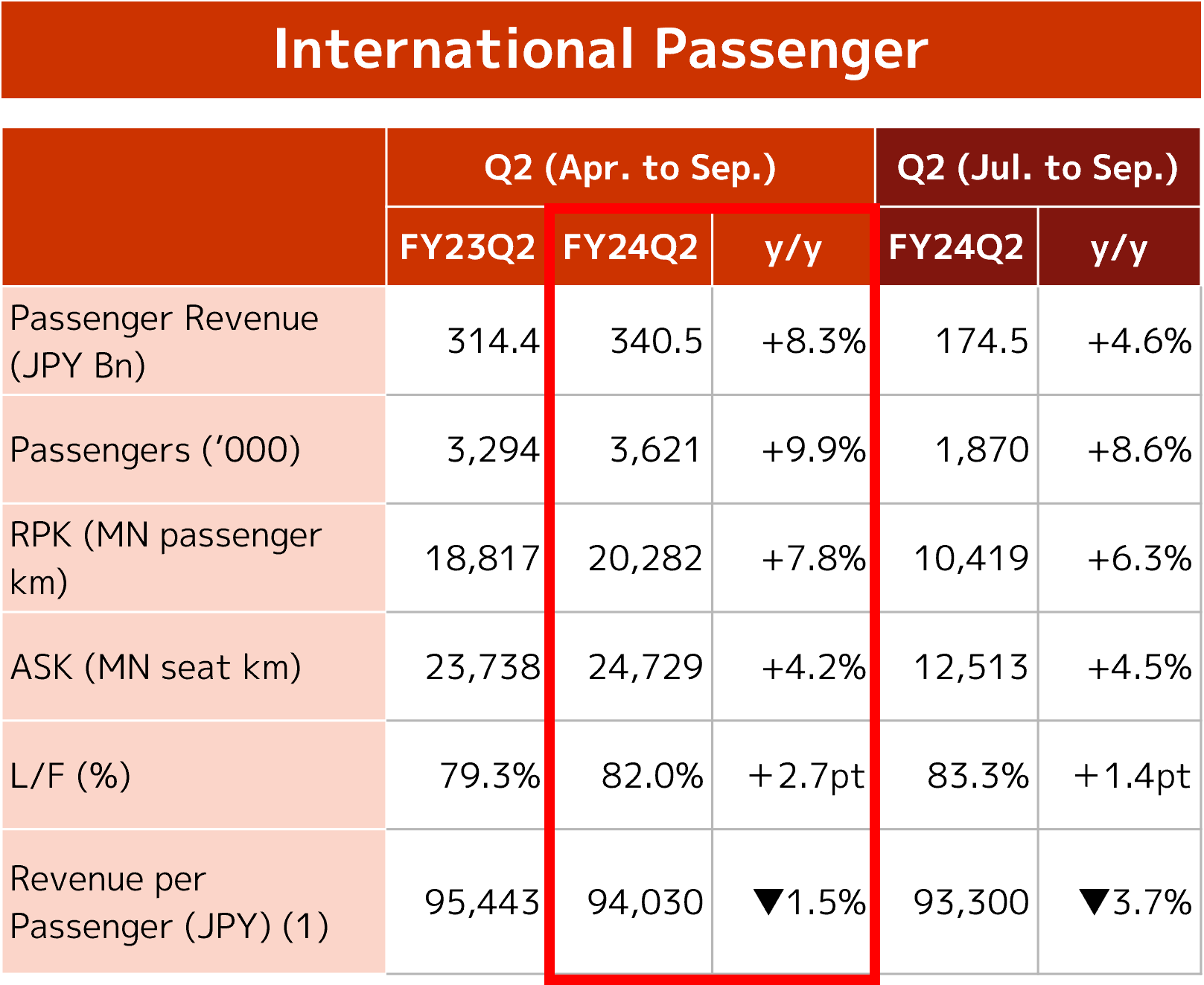

■ International Passenger

International passenger revenue increased by 8.3% year-on-year, maintaining high unit price levels by capturing strong inbound demand and the steady recovery of outbound business demand from Japan.

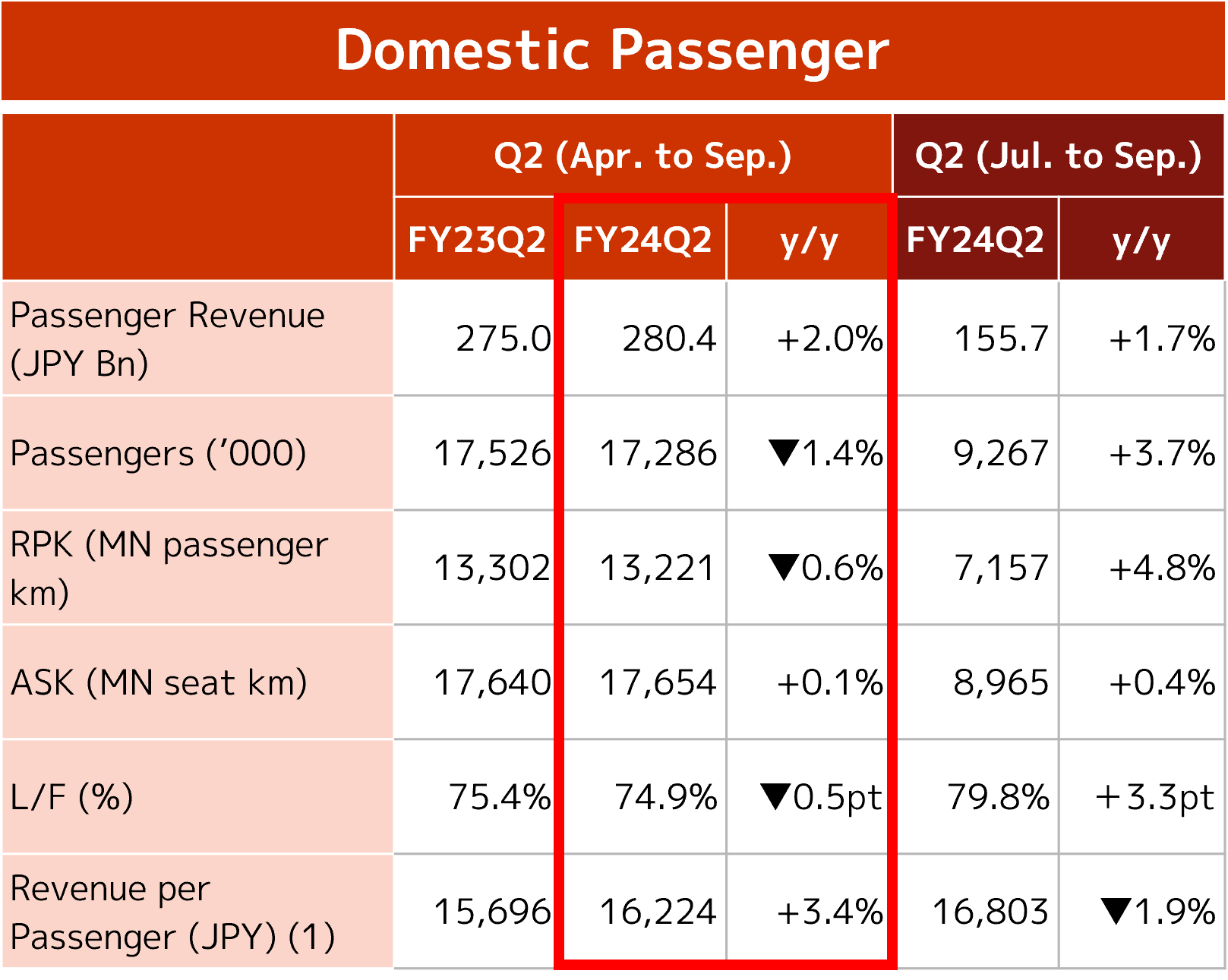

■ Domestic Passenger

Domestic passenger revenue increased by 2.0% year-on-year, although yield improved, leisure demand did not grow as expected. Various promotional campaigns have been implemented to stimulate demand, and revenue for the second half is expected to progress as initially planned.

(1)Passenger Revenue/Passengers

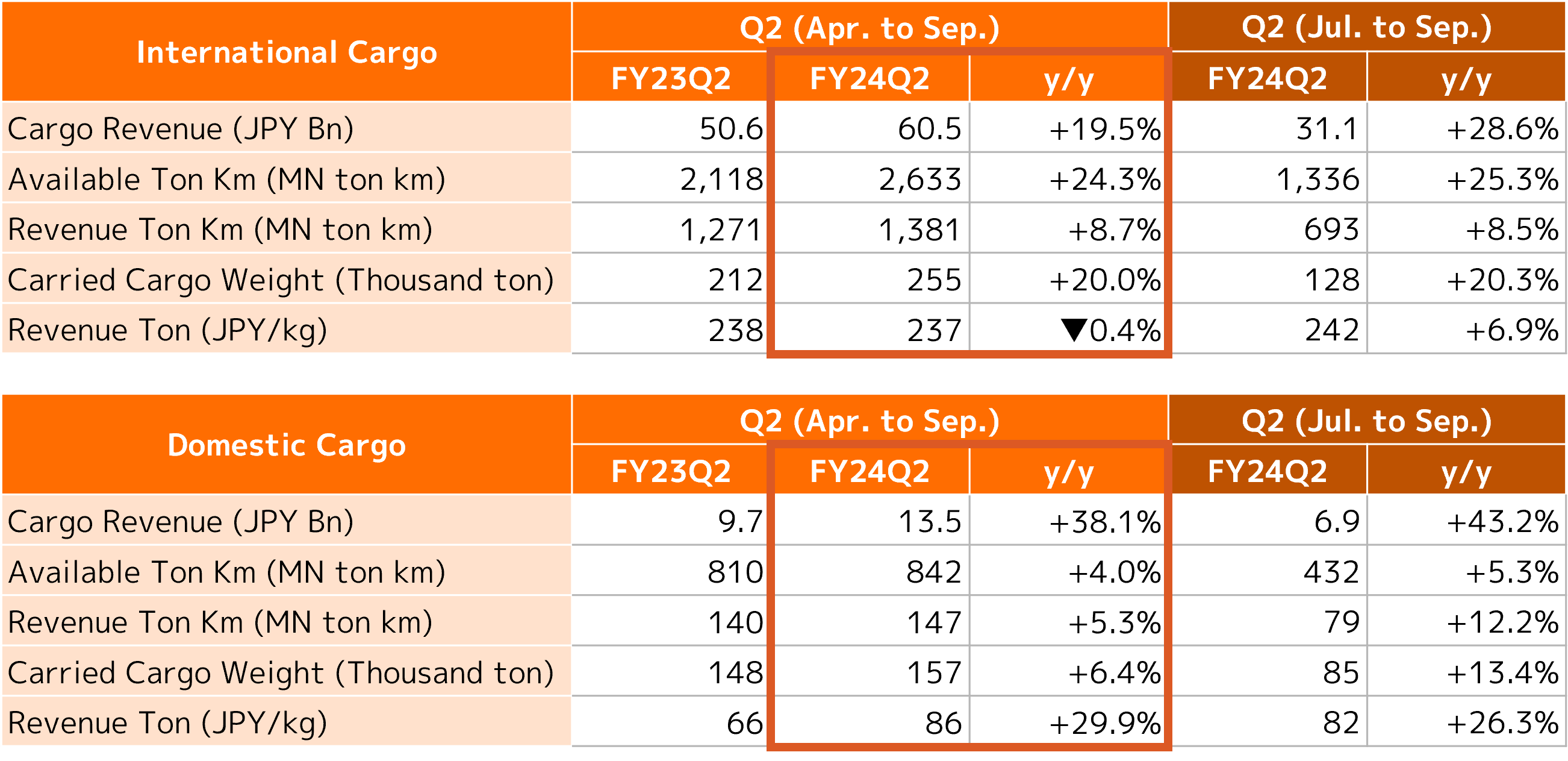

■ Cargo

For international cargo, efforts were made to capture high-value cargo such as pharmaceuticals and cargo from

China and Asia to the U.S. to increase transport weight and unit prices. For domestic cargo, the cargo

freighters in collaboration with Yamato Holdings began operations at Haneda in August, providing 13 flights per

day. These efforts resulted in significantly higher revenue compared to the previous year.

LCC Business

Revenue increased by 51.0% year-on-year to JPY 53.5 billion, and EBIT increased by 207% year-on-year to

JPY 7.7 billion.

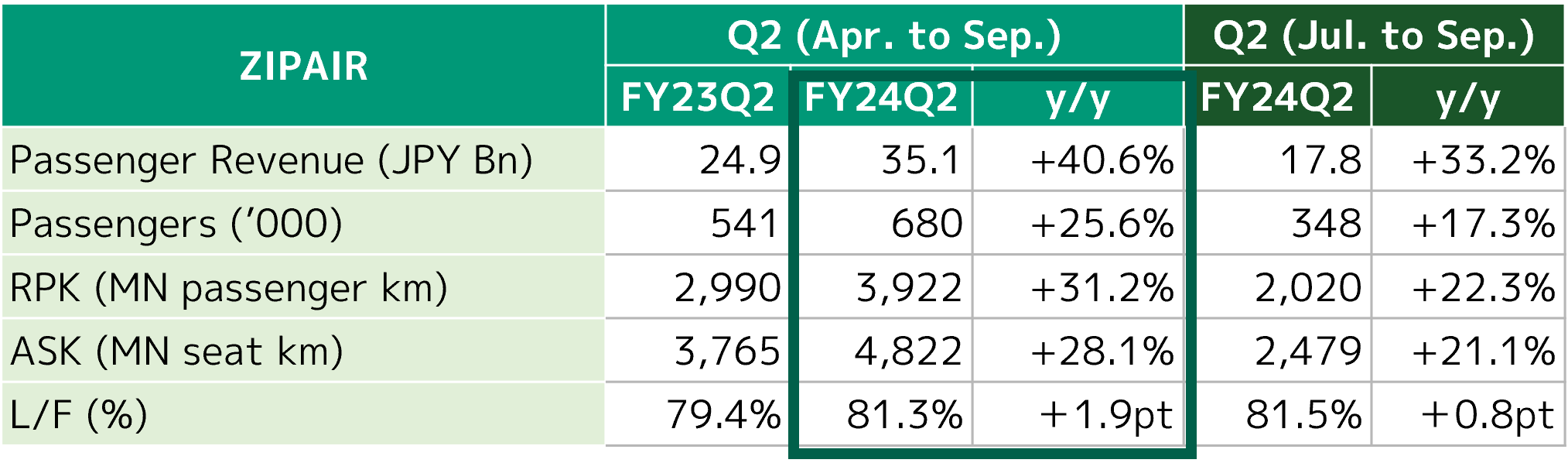

■ ZIPAIR

ZIPAIR expanded to 9 routes mainly in North America and Asia by the end of FY2023, capturing strong inbound demand and significantly increasing

operating profit.

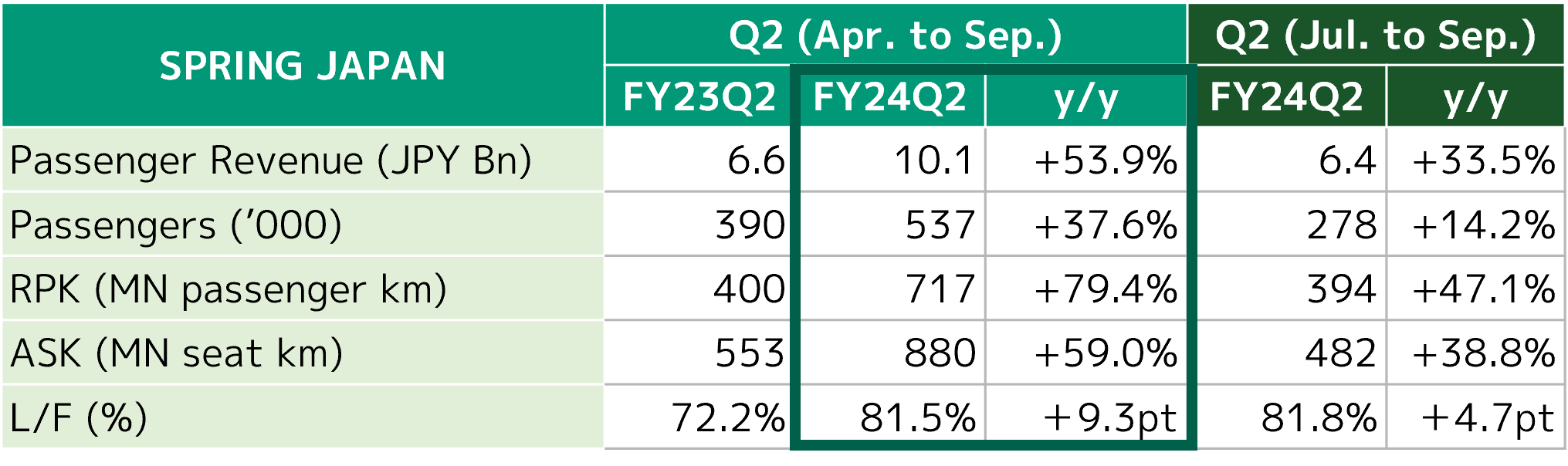

■ SPRING JAPAN

By starting operations to high-demand destinations such as Beijing and Shanghai, SPRING JAPAN captured the recovering demand from China and

became profitable.

Mileage/Finance and Commerce Business

Revenue increased by 4.5% year-on-year to JPY 98.6 billion due to increase in mileage points issued and

revenue from JALUX Inc. As a result, EBIT increased by 19.8% year-on-year to JPY 19.4 billion.

Others

Revenue increased by 8.6% year-on-year to JPY 120.3 billion due to a significant increase in the number of

ground handling contracts with other airlines. EBIT was a loss of JPY 1.4 billion for the second quarter of

FY2024 due to a temporary evaluation loss. However, for the cumulative second quarter, EBIT significantly

increased year-on-year to JPY 2.3 billion, driven by the ground handling business.

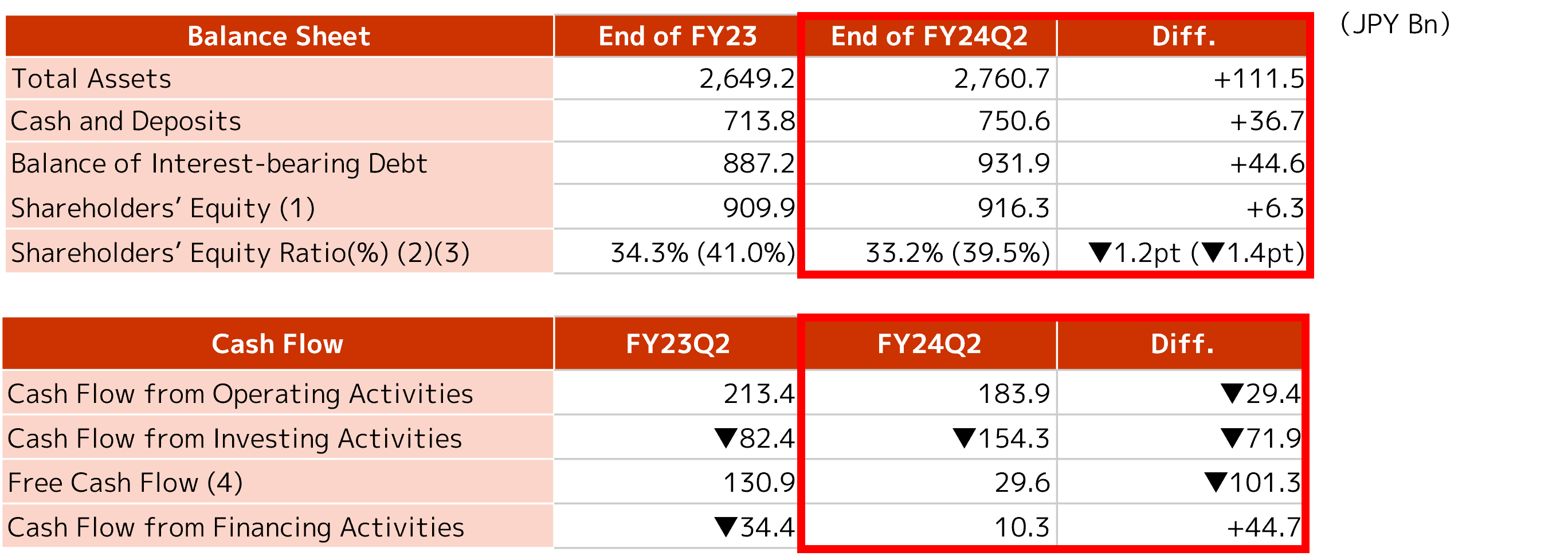

JAL Group Consolidated Financial Position and Cash Flow

3. Recent Initiatives

Full Service Carrier Business

- The sixth new Airbus A350-1000 aircraft has been delivered to the airline, and daily operations on the

Haneda-Dallas Fort Worth route began from August 23. The aircraft was also introduced on the

Haneda-London route starting from October 24.

- In the cargo and mail business, the Airbus A321-P2F aircraft, which began operations on domestic routes in

collaboration with Yamato Holdings on April 11, started operations at Haneda from August 1. In the winter

schedule, 14 flights per day, including the Kitakyushu-Sapporo route, are being operated.

- In terms of international partnerships, codeshare with India's largest airline, IndiGo, will begin from December,

and an agreement with Garuda Indonesia was made to start a joint business from spring 2025.

- Inflight Wi-Fi services began offering streaming video services on domestic flights from October 1, and free

services in all classes on international flights have been well received.

LCC Business

- ZIPAIR announced the launch of the Narita-Houston route, its first service to the southern United States,

starting March 4, 2025. SPRING JAPAN resumed the Narita-Nanjing route on October 27, after about a year

and a half, capturing the rapidly recovering demand from China.

Mileage/Finance and Commerce Business, and Others

- The "DREAM MILES PASS" project, supporting "youth across Japan who are pursuing their dreams" in

collaboration with a baseball superstar Shohei Ohtani, started on September 27. JMB members can participate

by donating their miles.

4. Forecast of Consolidated Financial Results for the fiscal year ending March 2025

The full-year forecast of consolidated financial results for the fiscal year ending March 2025 remains unchanged from the forecast announced on May 2, 2024, in the "Consolidated Financial Results for the Year Ended March 31, 2024," with the consolidated revenue of JPY 1 trillion 930.0 billion, the EBIT of JPY 170.0 billion, and the net profit of JPY 100.0 billion.

5. Dividends for the Current Fiscal Year

The annual dividend forecast for FY2024 also remains unchanged from the announcement on May 2, 2024,

“Consolidated Financial Results for the Year Ended March 31, 2024” with JPY 80 per share. Accordingly, the

interim dividend has been decided at JPY 40 per share.

The company considers shareholder returns as one of its top management priorities. While securing internal

reserves for future corporate growth and responding to changes in the business environment through

investments and building a strong financial foundation, the company aims to actively return profits to

shareholders through continuous and stable dividends, as well as flexible share buybacks.