Press Release

JAL Group Announces Consolidated Financial Results for the Third Quarter of Fiscal Year Ending March 2025

Summary

- Revenues and profits increased year-on-year. Revenues of both aviation and non-aviation businesses exceeded the previous year, with total revenue reaching JPY 1,385.9 billion (increase of 11% year-on-year), and EBIT was JPY 144.2 billion (increase of 12% year-on-year).

- For the third quarter alone, EBIT reached JPY 58.5 billion (increase of 55% year-on-year), marking the highest profit since re-listing.

- Business model reforms are progressing steadily and the achievement of the full-year performance forecast is on track.

Tokyo, JAPAN – The JAL Group today announced the consolidated financial results for the third quarter of the fiscal year ending March 2025 (April 1, 2024 - December 31, 2024).

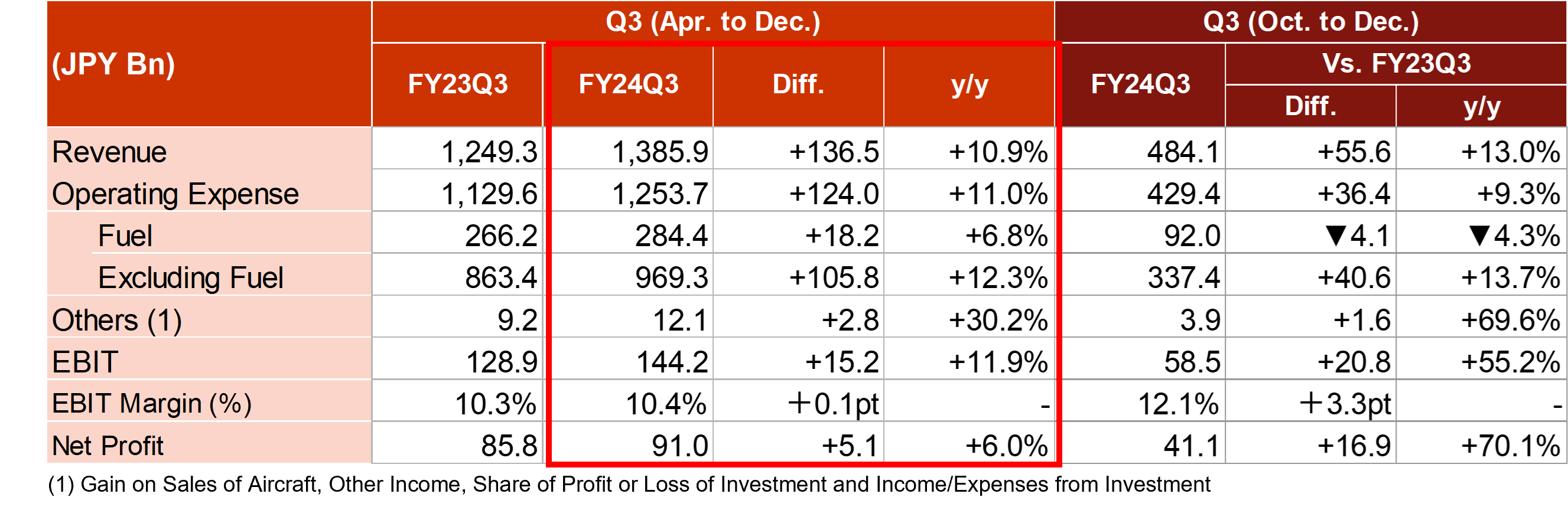

1. JAL Group Consolidated Financial Results

For the third quarter, revenue increased by 10.9% year-on-year to JPY 1,385.9 billion. Operating expenses increased by 11.0% year-on-year to JPY 1,253.7 billion, mainly due to higher fuel costs caused by the weaker Japanese yen and increased investment in human capital, which were effectively offset by the robust revenue growth. Consequently, EBIT was JPY 144.2 billion (increase of 11.9% year-on-year), and net profit was JPY 91.0 billion (increase of 6.0% year-on-year).

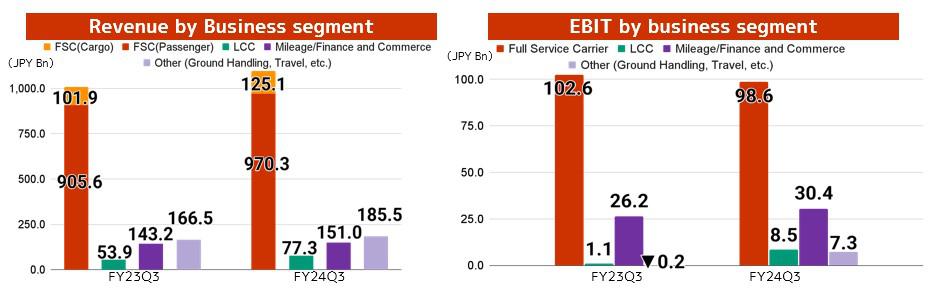

2. Performance by Business Segment

Revenues from both Full-service carriers, LCCs and non-aviation businesses such as Mileage/Finance and Commerce and Others exceeded those of the previous year. Additionally, due to increased profits in non-aviation businesses driven by business model reforms, the third quarter alone saw the highest profit since re-listing.

Full Service Carrier Business

Revenue increased by 8.7% year-on-year to JPY 1,095.4 billion, driven by strong international passenger demand, recovery in domestic passenger demand through promotional campaigns, and acquisition of high-value cargo using freighters. The strong revenue growth helped to balance the increased investment in human capital for future business expansion, resulting in a modest decrease in EBIT by 3.9% year-on-year to JPY 98.6 billion.

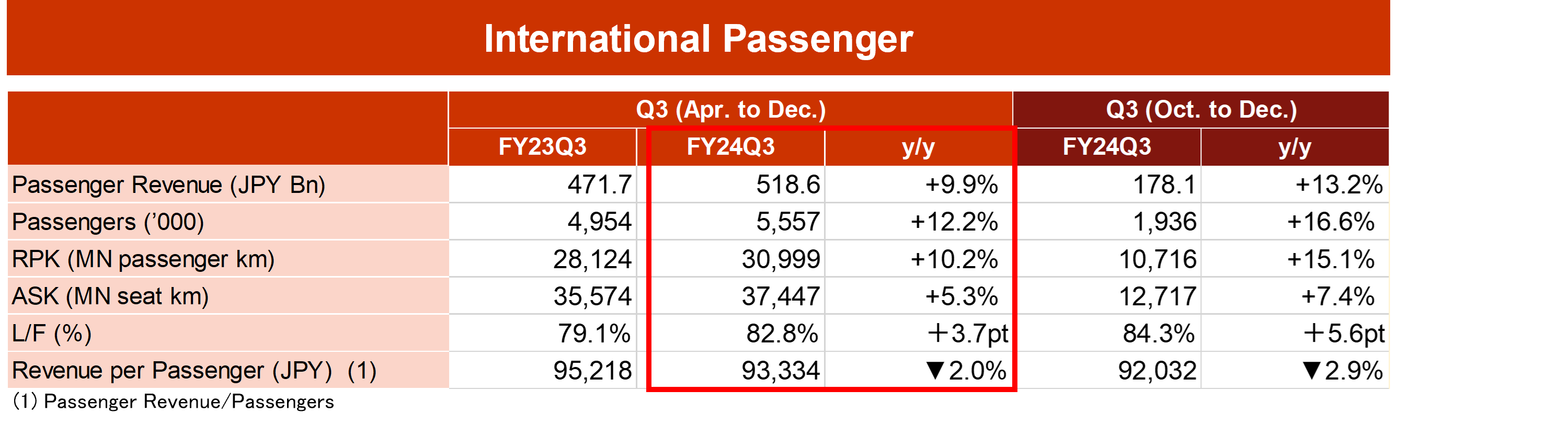

■ International Passenger

Following the first half, strong inbound demand and the gradual recovery of outbound business demand from Japan resulted in a 12.2% increase in passenger numbers year-on-year and a 9.9% increase in revenue year-on-year.

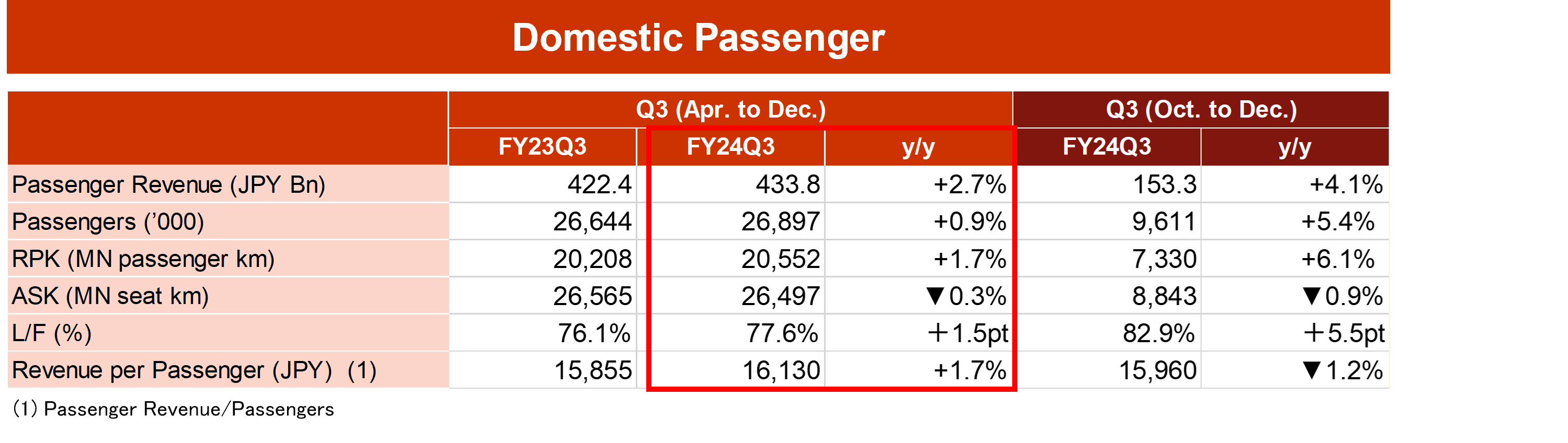

■ Domestic Passenger

Various promotional campaigns were implemented to stimulate demand, resulting in a 5.4% increase in passenger numbers year-on-year for the third quarter alone. The revenue passenger load factor reached a record high of 82.9%, leading to a 2.7% increase in cumulative revenue for the third quarter year-on-year.

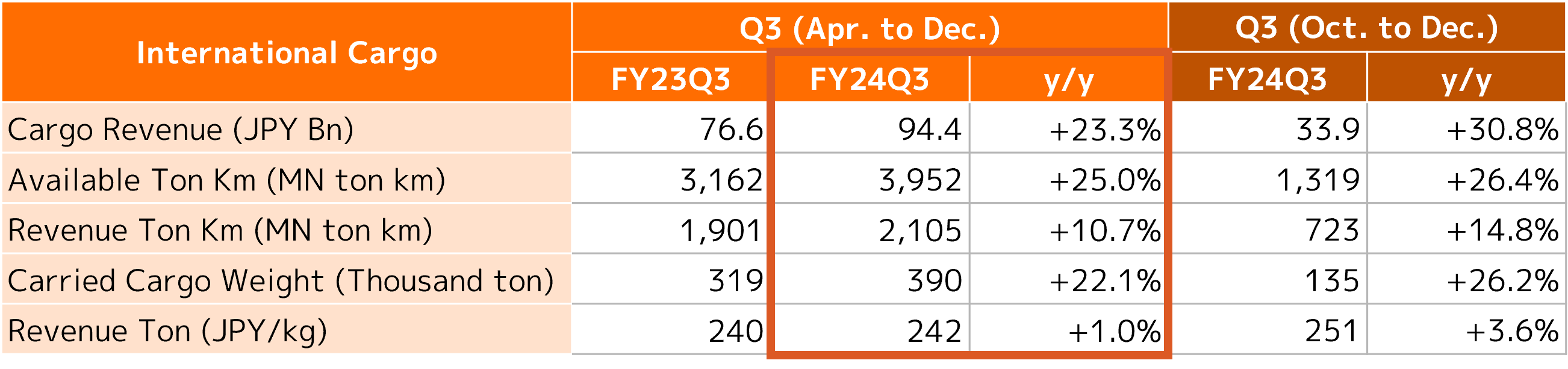

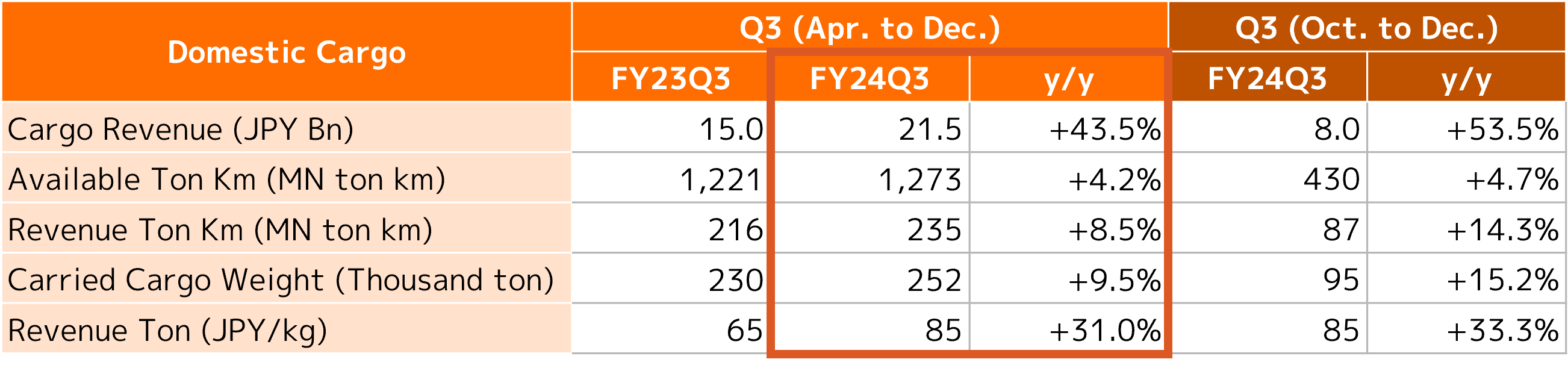

■ Cargo and Mail

For international cargo, efforts were strengthened to capture high-value cargo such as pharmaceuticals and cargo from China and Asia to the U.S. to increase transport weight and unit prices. These efforts resulted in significantly higher revenue compared to the previous year.

LCC Business

Revenue increased by 43.2% year-on-year to JPY 77.3 billion, and EBIT increased more than sevenfold year-on-year to JPY 8.5 billion.

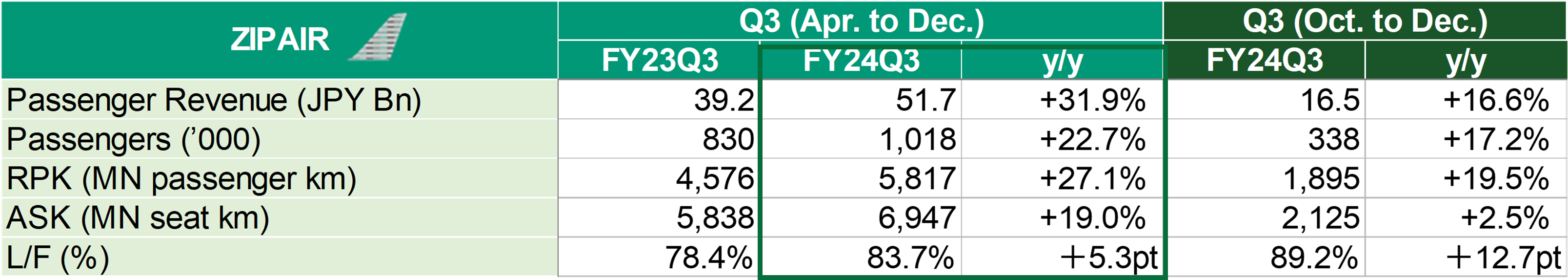

■ ZIPAIR

Strong inbound demand has been successfully captured on nine routes mainly in North America and Asia this term as well, continuing to maintain strong performance.

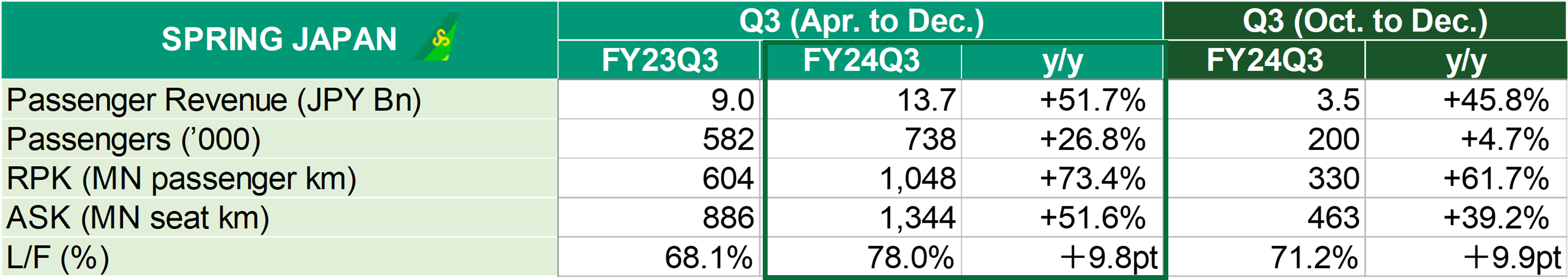

■ SPRING JAPAN

SPRING JAPAN captured recovering demand from China by starting operations to high-demand destinations such as Beijing and Shanghai, resulting in a steady increase in passenger revenue.

Mileage/Finance and Commerce Business

In addition to the increase in passenger numbers, the increase in miles issued due to higher JAL card transaction amounts, and the broad business expansion of JALUX's aviation-related businesses and airport stores, resulted in a 5.5% year-on-year increase in total revenue to JPY 151.0 billion. As a result, EBIT increased by 15.9% year-on-year to JPY 30.4 billion.

Other Business

Revenue increased by 11.4% year-on-year to JPY 185.5 billion due to a notable increase in the number of ground handling contracts with other airlines, among other factors. EBIT saw a substantial increase year-on-year to JPY 7.3 billion.

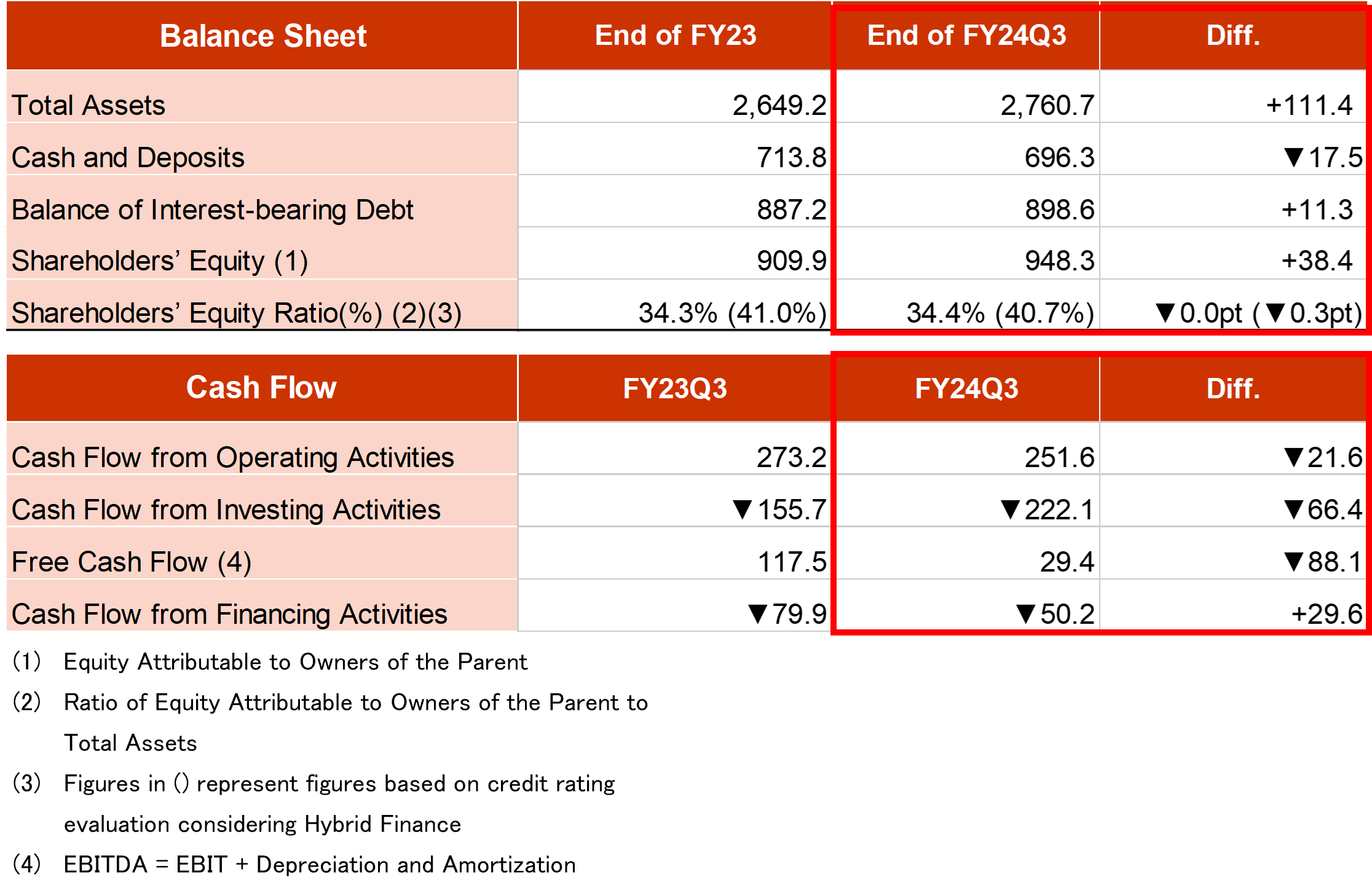

JAL Group Consolidated Financial Position and Cash Flow

3. Recent Initiatives

Full Service Carrier Business

- The eighth new Airbus A350-1000 aircraft has been delivered, and daily operations on the Haneda-London

route began from January 2. The aircraft will also be introduced on the Haneda-Paris route from May 1 and the

Haneda-Los Angeles route during the summer schedule of 2025.

- For domestic routes, a new "JAL Card Skymate" fare, which offers additional discounts for passengers aged 12 to 25, has been introduced in addition to the existing "Skymate" fare. A limited-time sale with uniform fares for

all domestic routes has also been implemented, among other initiatives, to stimulate demand among younger

passengers.

- For international cargo, the third 767-300BCF freighter began operations on January 14, providing a stable

international cargo transport network. Additionally, new initiatives for future business growth have been started,

such as reaching an agreement to expand the partnership with Qatar Airways Cargo and

becoming the first logistics company to be certified as a registered inspection agency for export plant quarantine.

For domestic cargo, 14 flights per day are operated with the Airbus A321-P2F aircraft in collaboration with

Yamato Holdings. Trial operations to Hiroshima Airport and Aomori Airport were conducted in January, and new

destinations are being considered.

- In terms of international partnerships, codeshare with India's largest airline, IndiGo, began from December 16,

and an agreement with Garuda Indonesia was made to start a joint business from spring 2025.

- An international partnership agreement with Major League Baseball (MLB) was signed in December 2024. As

an official sponsor, JAL will enhance the 2025 season with spectator tours and promotions focusing on JAL's

flight destinations, contributing to the creation of human flow between Japan and the U.S.

Sustainability

JAL was selected for the third consecutive year as a component of the "Dow Jones Sustainability Asia Pacific Index," a representative index for ESG (Environmental, Social, and Governance) investment.

LCC Business

In October 2024, ZIPAIR was selected as a "4-Star Airline (LCC category)" by APEX, an international airline rating organization. Additionally, starting March 4, 2025, ZIPAIR will launch a new Narita-Houston route, its first service to the southern United States, increasing its destinations to 10, mainly in North America and Asia.

SPRING JAPAN, celebrating its 10th anniversary, continues to capture the recovering demand from China.

Mileage/Finance and Commerce Business

The “JAL Life Status Program,” a lifetime activity program that offers status and benefits based on Life Status Points accumulated through qualifying JAL Group flight activity and lifestyle services activity, celebrated its first anniversary. From January 2025, the validity period of miles will be extended or made unlimited according to the status, further enhancing the program to be more closely aligned with customers' daily lives.

On-time Performance

JAL was named the top airline in the Asia-Pacific region for on-time performance in 2024 by Cirium, a UK-based travel data and analytics firm, with an on-time arrival rate of 80.90%.

4. Forecast of Consolidated Financial Results and Dividend for the fiscal year ending March

2025

The full-year forecast of consolidated financial results for the fiscal year ending March 2025, announced on May 2, 2024, in the "Consolidated Financial Results for the Year Ended March 31, 2024," remains unchanged, with consolidated revenue of JPY 1,930.0 billion, EBIT of JPY 170.0 billion, and net profit of JPY 100.0 billion. The annual dividend forecast also remains unchanged at JPY 80 per share.