Press Release

JAL Group Announces Consolidated Financial Results for Fiscal Year Ending March 2025

Summary

- Revenue reached a record high of JPY 1,844 billion (up 12% year-on-year) since relisting, EBIT grew by 19% to JPY 172.4 billion, and net profit for the period was JPY 107.0 billion (up 12% year-on-year), resulting in increased revenue and profit.

- All business segments achieved increased revenue and profit due to the progress in business model reforms.

- Following the strong financial performance, the proposed year-end dividend has been raised to JPY 46 per share, making the annual dividend to JPY 86 per share (payout ratio of 35%).

- In the upcoming fiscal year 2025, JAL aims to advance business model reforms and improve productivity, targeting revenue of JPY 1,977 billion and EBIT of JPY 200.0 billion.

Tokyo, JAPAN – The JAL Group today announced its consolidated financial results for the fiscal year ending March 2025 (April 1, 2024 - March 31, 2025).

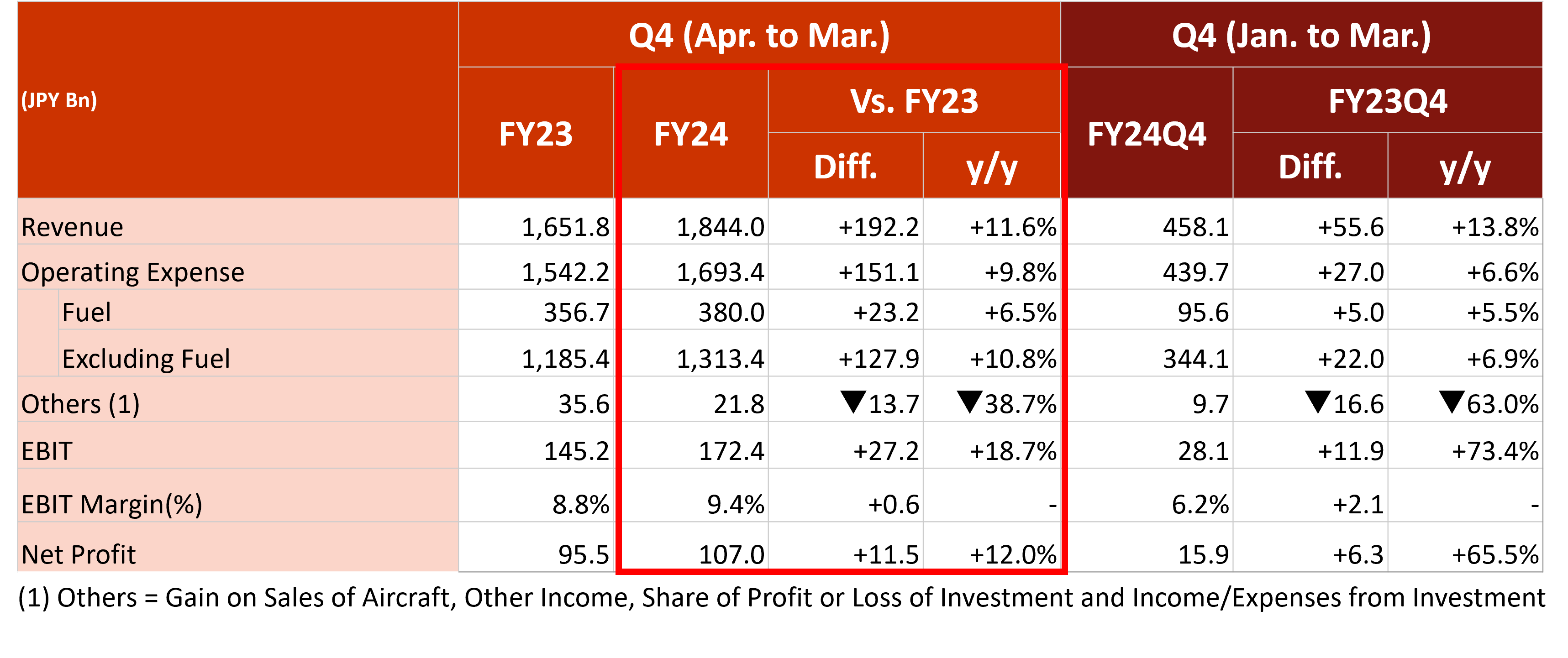

1. JAL Group Consolidated Financial Results

For the fiscal year ending March 2025, revenue reached a record high of JPY 1,844 billion (up 11.6% year-on-year) since relisting, while operating expenses increased by 9.8% year-on-year to JPY 1,693.4 billion, mainly due to factors such as the weaker Japanese yen, higher prices, and increased investment in human capital. Consequently, EBIT reached JPY 172.4 billion (an increase of 18.7% year-on-year), and net profit was JPY 107.0 billion (an increase of 12.0% year-on-year).

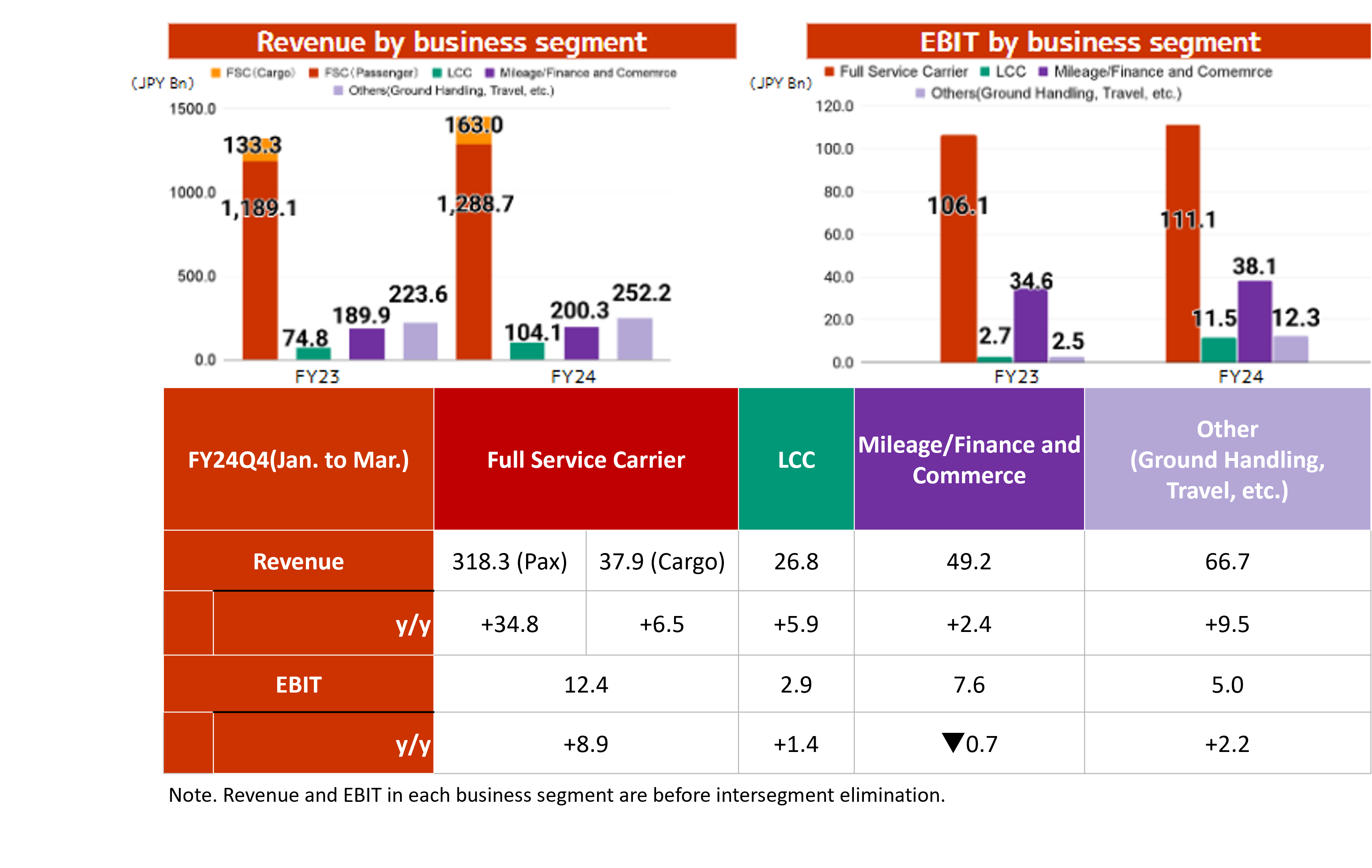

2. Performance by Business Segment

Revenues from both Full-service carriers, LCCs, and non-aviation businesses such as Mileage/Finance and Commerce and Others exceeded those of the previous year. Additionally, due to increased profits in non-aviation businesses driven by business model reforms, profits from non-full-service carrier businesses saw significant growth.

Full Service Carrier Business

Revenue increased by 9.8% year-on-year to JPY 1,451.8 billion, driven by strong international passenger demand, domestic passenger demand captured through promotional campaigns and acquisition of high-value cargo using freighters. EBIT increased by 4.7% year-on-year to JPY 111.1 billion.

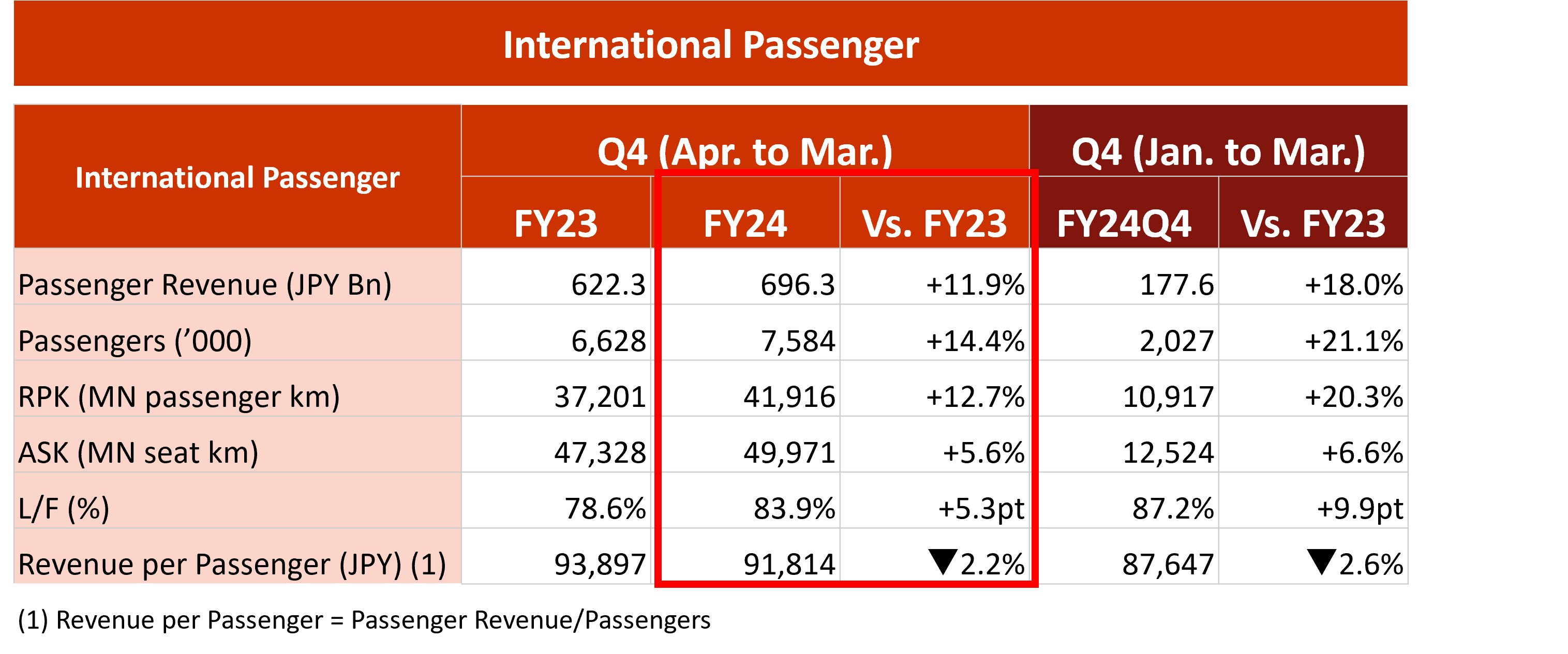

■ International Passenger

Strong inbound demand continued and the recovery trend in outbound business demand from Japan resulted in a 14.4% increase in passenger numbers year-on-year and an 11.9% increase in revenue year-on-year.

■ Domestic Passenger

Various promotional campaigns were implemented to stimulate demand, resulting in a record high revenue passenger load factor of 82.9% for the fourth quarter alone. As a result, the full-year passenger numbers increased by 2.9% year-on-year, and passenger revenue increased by 3.7% year-on-year.

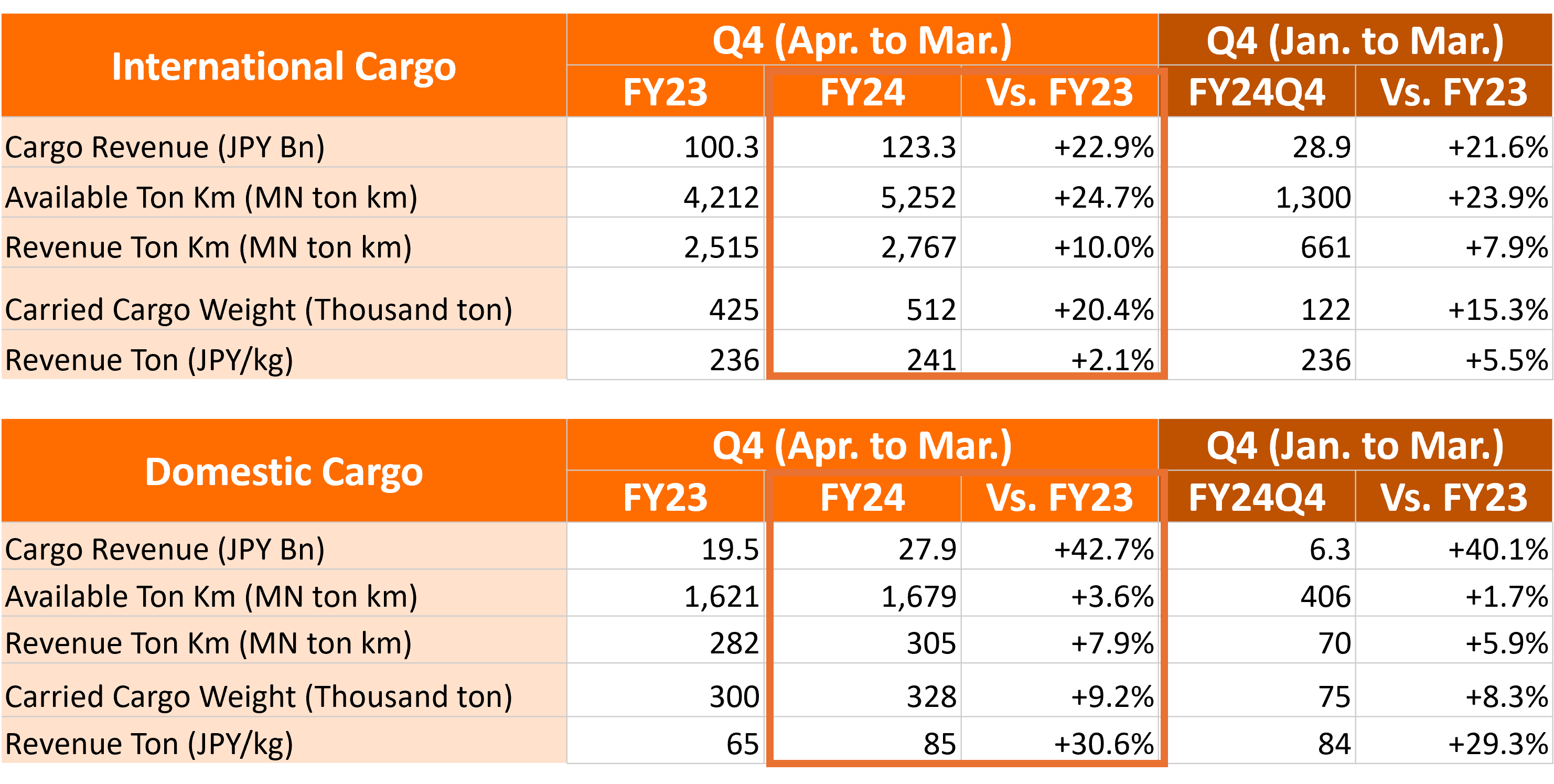

■ Cargo and Mail

For international cargo, efforts were strengthened to capture high-value cargo such as pharmaceuticals and cargo from China and Asia to the U.S., resulting in increased transport weight and unit prices, achieving higher revenue. For domestic cargo, efforts to capture new demand resulted in increased revenue.

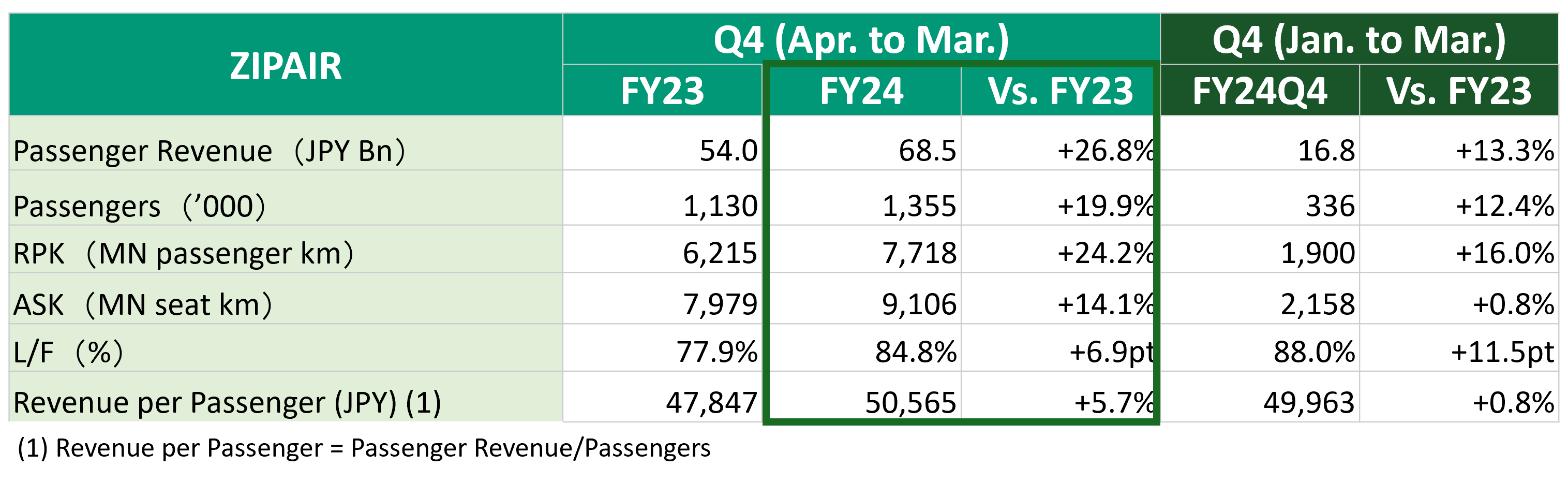

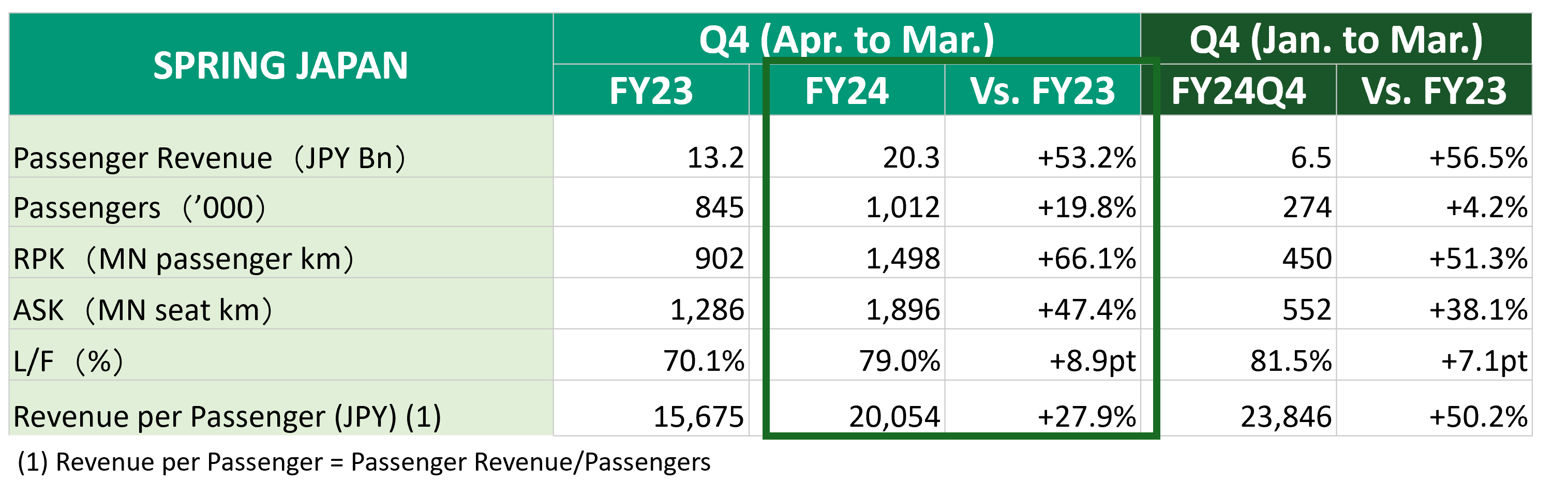

LCC Business

Due to the strong demand in the LCC market, revenue increased by 39.1% year-on-year to JPY 104.1 billion, and EBIT increased more than fourfold year-on-year to JPY 11.5 billion.

■ ZIPAIR

Strong inbound demand has been successfully captured, maintaining strong performance. ZIPAIR launched a new route to Houston in March 2025, increasing its destinations to 10, mainly in North America and Asia.

■ SPRING JAPAN

SPRING JAPAN captured recovering demand from China by starting operations to high-demand destinations such as Beijing and Shanghai (Pudong), resulting in a steady increase in passenger revenue and achieving profitability.

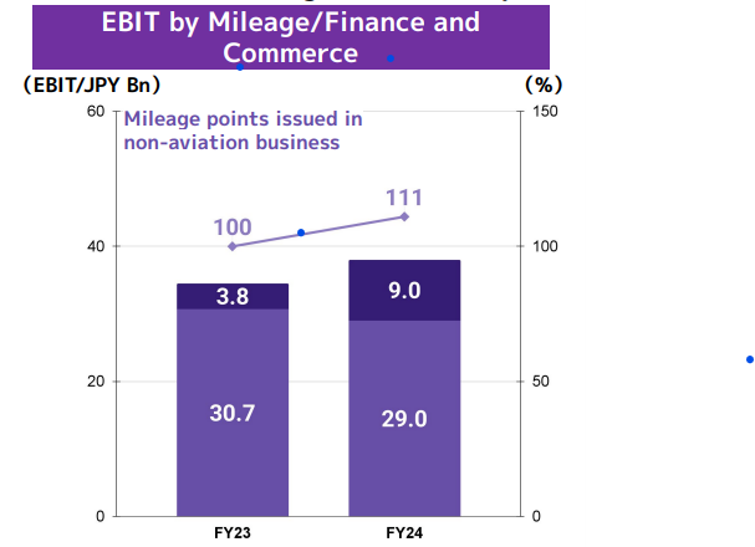

Mileage/Finance and Commerce Business

In addition to the increase in passenger numbers, the increase in miles issued due to higher JAL card transaction amounts, and the broad business expansion of JALUX's aviation-related businesses and airport stores, resulted in a 5.5% year-on-year increase in total revenue to JPY 200.3 billion. Consequently, EBIT increased by 10.0% year-on-year to JPY 38.1 billion, steadily growing profits.

Other Business

Due to a significant increase in the number of ground handling contracts with other airlines, revenue increased by 12.8% year-on-year to JPY 252.2 billion, and EBIT reached JPY 12.3 billion.

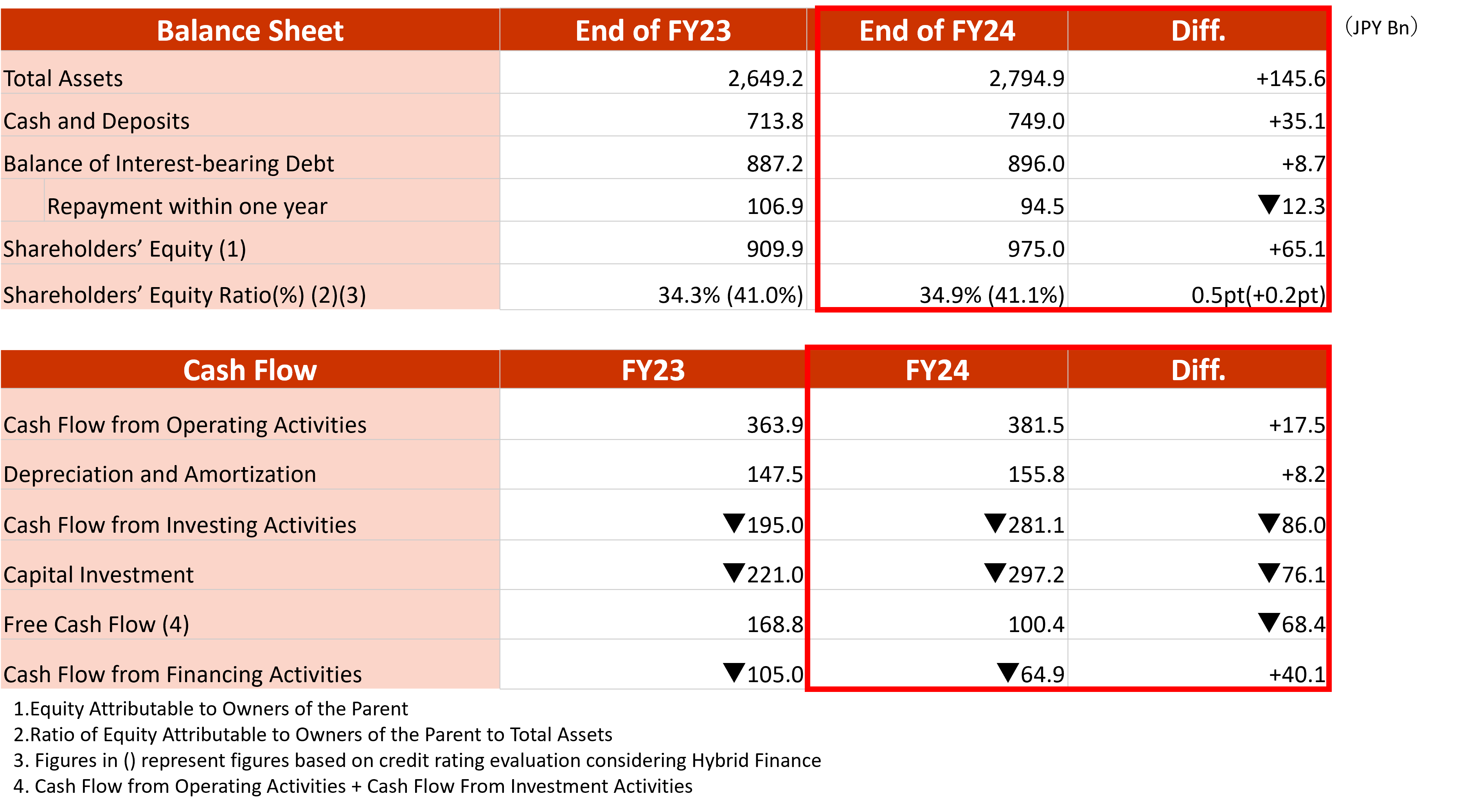

3. JAL Group Consolidated Financial Position and Cash Flow

4. Recent Initiatives

Expo 2025 Osaka, Kansai, Japan

- At the Expo 2025 Osaka, Kansai, Japan (The Expo), JAL is working towards three goals to realize the vision

of a sustainable society aimed by the Expo and JAL's vision:

1. Make Air Travel More Accessible

2. Create Purposes for People to Travel to Various Regions of Japan

3. Promoting Regional Attractions and Creating New Flows of People

- JAL established an immersive theater "SoraCruise by Japan Airlines" within the "Advanced Air Mobility

Station" exhibition facility, challenging the creation of new mobility value using next-generation mobility.

- In collaboration with Bandai Namco Holdings Inc., the "JAL×GUNDAM FLY TO THE FUTURE PROJECT" has been launched, and has been operating the special Expo-edition aircraft "JAL Gundam JET" since March 3, 2025.

Full Service Carrier Business

International

- Starting in April 2025, JAL commenced a joint business venture with Garuda Indonesia, enhancing customer convenience and contributing to the economic development and strengthening of the partnership between the two countries.

- To meet the demand between Japan and North America, as well as the connecting demand between Southeast Asia/India and North America, the Tokyo (Narita)-Chicago route will be opened from May 31, 2025. Additionally, from July 2025, the frequency of flights on the Osaka (Kansai)-Honolulu and Nagoya (Chubu)-Honolulu routes will be increased to capture tourism demand to Hawaii.

- From fiscal year 2027 onwards, JAL will introduce ten Boeing 787-9 aircraft and twenty Airbus A350-900

aircraft, increasing the number of seats offered and enhancing service quality and convenience, further

expanding the business scale.

Domestic

- The "DEEEEP JAPAN" project, which proposes diverse plans to rediscover the deep aspects of Japan, and

the JTB and JAL's New Project to Promote Regional Japan contributed to regional development by

attracting inbound tourists to various regions of Japan.

- In addition to the Boeing 737-8 aircraft, 11 Airbus A321neo aircraft, which have been decided to be

introduced as replacement aircraft for the Boeing 767, will be deployed mainly on Haneda routes from fiscal

year 2028. This will contribute to regional development by attracting inbound tourists to various regions of

Japan.

Cargo

- For international cargo, the Tokyo (Narita)-Hanoi route for cargo aircraft began operations from March,

2025. This route is JAL's first regular service to Southeast Asia since the resumption of cargo aircraft

operations.

- A codeshare agreement with KALITTA Air was signed and regular cargo flights on the Tokyo

(Narita)-Chicago route will begin from May 10, 2025. This codeshare will expand JAL's air cargo transport

network between Asia and North America, responding to the growing demand for cargo transport.

- In February 2025, JAL obtained IATA's CEIV Lithium Battery Transport Certification. This certification

ensures high-quality and safety in the air transport of lithium batteries, allowing JAL to provide reliable

transport services.

LCC Business

- ZIPAIR aims to double its business scale by the early 2030s and has decided to transfer 787-9 aircraft

from JAL starting from fiscal year 2027.

- SPRING JAPAN has reached a total of 6 million cumulative passengers in March 2025. The frequency of

flights to Shanghai (Pudong) has been increased and operations to major cities such as Beijing and Dalian

have begun, steadily accumulating profits.

Mileage/Finance and Commerce Business

- The special domestic "JALCARD Sky Mate Fare" for JAL card members under 25 years old, introduced in

February 2025, has promoted usage among younger customers, resulting in more than double the number

of JAL card memberships under 25 years old by the end of March.

- In March 2025, JAL NEOBANK PREMIUM was launched, introducing services that efficiently accumulate

miles through deposits in yen and foreign currency savings accounts.

- The cumulative sales of 'JAL Special Original Beef Curry' have surpassed 1 million servings. Future plans

include expanding the lineup of JAL SELECTION products, which have been well received by customers.

- This fiscal year, services such as "JAL Mobile" and "JAL/JCB Card Platinum Pro" have been introduced,

making it easier to accumulate and use miles.

Sustainability

From May 1, 2025, JAL began using domestic SAF derived from waste cooking oil from the Cosmo Group. Additionally, JAL has started efforts with Airbus, Nippon Paper Industries, Sumitomo Corporation, and Green Earth Institute to realize pure domestic SAF derived from domestic wood, accelerating efforts to achieve net-zero CO2 emissions by 2050.

5. Dividend

For the fiscal year ending March 2025, due to the performance exceeding the forecast, the year-end dividend has been increased from JPY 40 to JPY 46 per share, and the annual dividend has been increased from JPY 80 to JPY 86 per share.

For the fiscal year ending March 2026, the forecast announced on March 19, 2025, remains unchanged, with an annual dividend forecast of JPY 92 per share (dividend payout ratio of 35.0%), including an interim dividend forecast of JPY 46 per share.

JAL will continue to strive to achieve continuous and stable shareholder returns as its basic policy.

6. Future Outlook

The full-year consolidated financial forecast for the fiscal year ending March 2026, announced in the 'JAL Group Medium-Term Management Plan Formulated Rolling Plan 2025' on March 19, 2025, remains unchanged. The forecast includes consolidated revenue of JPY 1,977.0 billion, EBIT of JPY 200.0 billion, and net profit of JPY 115.0 billion.

For the first quarter (April - June 2025), strong inbound demand is expected to continue, along with ongoing domestic promotional campaigns, resulting in international and domestic passenger numbers exceeding both the previous year and the plan.