Press Release

JAL Group Announces Consolidated Financial Results for the First Quarter of Fiscal Year Ending March 2026

Summary

- Revenue exceeded the previous year in both aviation and non-aviation businesses, reaching JPY 471.0 billion (up 11.1% year-on-year).

- EBIT doubled compared to the previous year to JPY 45.5 billion (up 105.7% year-on-year), achieving a record high first-quarter profit.

- The results for this period shows solid progress toward the fiscal year targets of EBIT JPY 200.0 billion and net profit JPY 115.0 billion.

Tokyo, JAPAN – The JAL Group today announced its consolidated financial results for the first quarter of the fiscal year ending March 2026 (April 1, 2025 - June 30, 2025).

1. JAL Group Consolidated Financial Results

For the first quarter, revenue increased by 11.1% year-on-year to JPY 471.0 billion. While fuel costs decreased due to the declining fuel price and the Japanese yen turning to a stronger trend, the overall operating expenses rose by 7.2% year-on-year to JPY 435.4 billion due to inflation and increased investment in human capital. As a result, EBIT was JPY 45.5 billion (up 105.7% year-on-year), and net profit was JPY 27.0 billion (up 93.7% year-on-year).

2. Performance by Business Segment

Revenues and profits increased year-on-year in the Full-service carrier and LCCs, as well as in the Mileage/Finance and Commerce segments.

Full Service Carrier Business

Revenue increased by 10.4% year-on-year to JPY 369.3 billion, driven by strong international passenger demand, flexible revenue management capturing domestic passengers, and expanded cargo demand through growth of the freighter network. EBIT increased 288.3% year-on-year to JPY 30.7 billion.

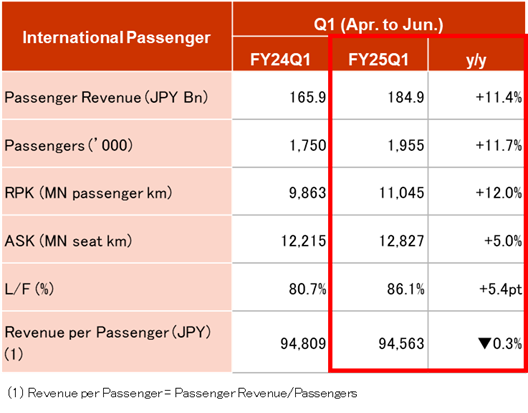

■ International Passenger

Strong inbound demand continued along with recovery in outbound business demand from Japan, resulting in an 11.7% increase in passenger numbers and an 11.4% increase in passenger revenue year-on-year.

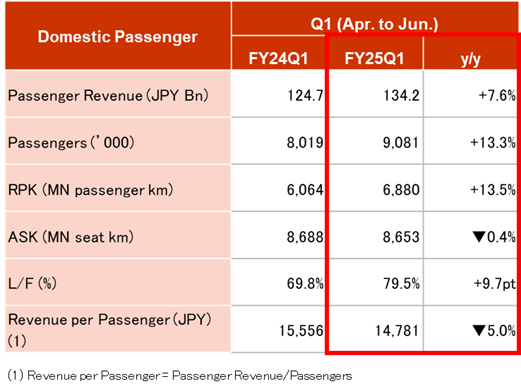

■ Domestic Passenger

Effective revenue management led to a 13.3% increase in passenger numbers and a 7.6% increase in passenger revenue year-on-year.

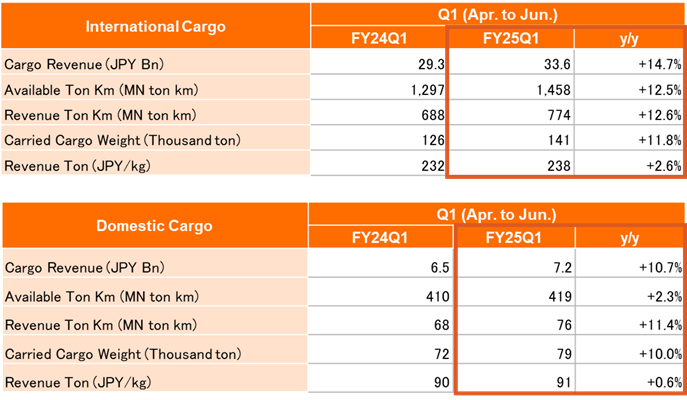

■ Cargo and Mail

International cargo revenue increased due to the expansion of the freighter network and strengthened efforts to capture cargo from China and Asia to North America. Domestic cargo revenue also rose, supported by joint operations of cargo aircraft with the Yamato Group.

LCC Business

Reflecting strong growth in the LCC market, revenue increased by 23.2% year-on-year to JPY 30.4 billion, and EBIT increased 91.9% year-on-year to JPY 4.2 billion.

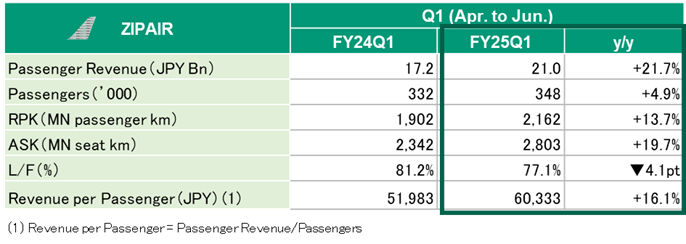

■ ZIPAIR

Robust inbound demand was successfully captured, including the new Houston route launched in March 2025, maintaining strong performance.

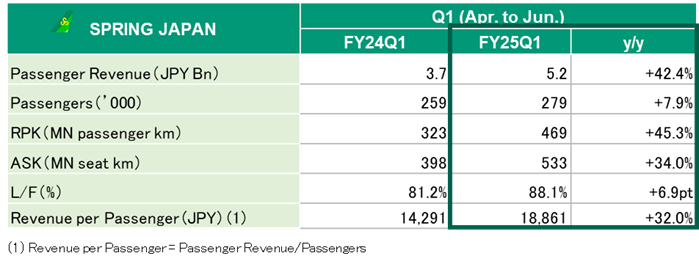

■ SPRING JAPAN

Strong passenger demand, centered on major Chinese cities such as Beijing and Shanghai (Pudong), led to stable passenger revenue growth.

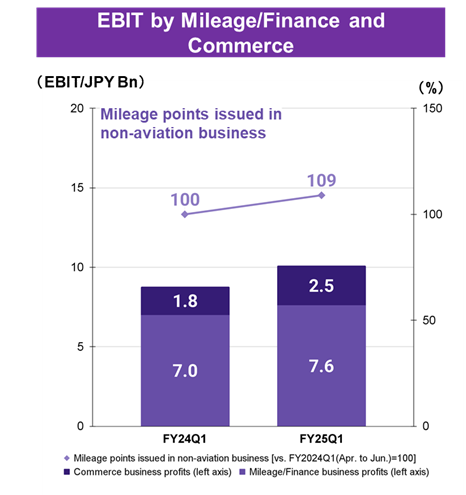

Mileage/Finance and Commerce Business

In addition to the increase in passenger numbers, issuance of miles associated with JAL card payment enhancements led to a 7.9% increase in revenue to JPY 49.7 billion and a 15.2% increase in EBIT to JPY 10.2 billion, maintaining steady profit growth.

Other

Ground handling services continued to perform solidly, with revenue increasing 9.4% year-on-year to JPY 59.9 billion and EBIT at JPY 1.3 billion.

3. JAL Group Consolidated Financial Position and Cash Flow

4. Recent Initiatives

Full Service Carrier Business

International

- The Tokyo (Narita)–Chicago route was launched on May 31, 2025, and together with flights departing from Haneda Airport, operates two flights daily. This service addresses demand between Japan and North America as well as connecting demand between Southeast Asia/India and North America. From July 2025, flight frequencies on the Osaka (Kansai)-Honolulu and Nagoya (Chubu)–Honolulu routes were increased to capture growing tourism demand for Hawaii.

- The Tokyo (Haneda)–Los Angeles route began operating Airbus A350-1000 aircraft on June 30, 2025. The 10th A350-1000 aircraft is scheduled for introduction in July. JAL will continue expanding its A350-1000 fleet, offering customers superior comfort and advanced environmental performance.

Domestic

- The JAL Dynamic Package website, available only in Japanese, has been completely redesigned, offering new features such as the ability to search for accommodations on Google Maps and filter options based on over 100 personalized preferences. This renewal transforms the experience from “the hassle of booking a trip” into “the joy of planning one.”

- From May to October 2025, “Saver” fares usable even on the day of departure were introduced on Tokyo (Haneda)–Osaka (Itami) and Komatsu routes, enhancing convenience for last-minute travelers.

Cargo

- A codeshare agreement with KALITTA Air commenced from May 10, 2025, with scheduled cargo flights between Tokyo (Narita)–Chicago. Passenger flights started on this route from May 31, 2025, enabling dual use of passenger and cargo flights to meet increasing cargo demand between Asia and North America.

- The “WING NRT” logistics hub—Japan's first integrated aviation and logistics facility near Narita Airport—is under joint operation with Hulic Co., Ltd., preparing to meet rising international cargo demand expected with the opening of Narita’s third runway in 2029.

- From July 2025, JAL began offering “J SOLUTIONS PHARMA CELLS,” a specialized cell transport service supporting regenerative medicine, providing faster and more careful transport for medical advancements.

LCC Business

- ZIPAIR will increase frequency on the Tokyo (Narita)–Bangkok route during the summer peak season, offering more schedule options to improve customer convenience.

Mileage/Finance and Commerce Business

- Starting April 2025, “JAL Mobile,” a mobile communication service earning miles, has been offered to JAL Mileage Bank members, receiving favorable customer feedback due to benefits like domestic round-trip tickets.

- The “JAL JCB Card Platinum Pro” was launched in April 2025 to meet the needs of customers seeking premium services and high status. It offers exclusive benefits such as two types of bonus miles—a first for JAL cards—and e-coupons for Sakura Lounge access.

- In July 2025, JAL Group and SBI Liquidity Market signed a share acquisition agreement with Nojima Corporation to acquire all shares of Money Square HD, aiming to strengthen the financial business and accelerate growth in non-aviation businesses by linking everyday life with extraordinary travel experiences.

- The “Smart Brain Dock” health checkup service provided by EUCALIA has been launched for JAL Mileage Bank members as of July 2025. By offering a new health habit that increases interest in preventive medicine, this service aims to realize well-being by extending healthy life expectancy and improving quality of life.

Regional Revitalization

- The dual residence Promotion Consortium, formed by JAL and local governments, has been recognized as a leading initiative to promote “Dual Residence Lifestyle.” On July 1, 2025, it received support from the Ministry of Land, Infrastructure, Transport and Tourism. The consortium offers a program called “Creating Connections in Dual Residence Lifestyle” that enables people to experience dual residence while reducing travel costs by using JAL miles. This program aims to establish a sustainable model benefiting local governments, dual residents, and related businesses.

Sustainability

- Since May 2025, JAL has used domestically produced SAF derived from waste cooking oil provided by Cosmo Group, starting with Kansai International Airport on May 1, expanding to Haneda Airport on July 7.

5. Financial Forecast and Dividend for Fiscal Year Ending March 2026

The full-year consolidated financial forecast for the fiscal year ending March 2026 remains unchanged from the forecast announced in the “Consolidated Financial Results for the year Ended March 31, 2025” on May 2, 2025. The forecast includes consolidated revenue of JPY 1,977.0 billion, EBIT of JPY 200.0 billion, and net profit of JPY 115.0 billion. The annual dividend forecast remains JPY 92 per share.