Press Release

JAL Group Announces Consolidated Financial Results for the Second Quarter of Fiscal Year Ending March 2026

Summary

- Revenue exceeded the previous year in both aviation and non-aviation businesses, achieving a cumulative record high of JPY 983.9 billion for the first half, the highest since the company’s re-listing (up 9.1% year-on-year).

- EBIT for the first half increased by 28.0% year-on-year to JPY 109.7 billion, achieving profit growth compared to the previous year.

- The full-year forecast of EBIT JPY 200.0 billion, net profit JPY 115.0 billion, and annual dividend forecast of JPY 92 per share remain unchanged. The interim dividend has been set at JPY 46 per share.

- As part of shareholder returns, a total share buyback of JPY 20 billion will be conducted. Consequently, the company expects to achieve the shareholder return target of approximately a 50% total payout ratio set forth in the medium-term management plan.

Tokyo, JAPAN – The JAL Group today announced its consolidated financial results for the second quarter of the fiscal year ending March 2026 (April 1, 2025 - September 30, 2025).

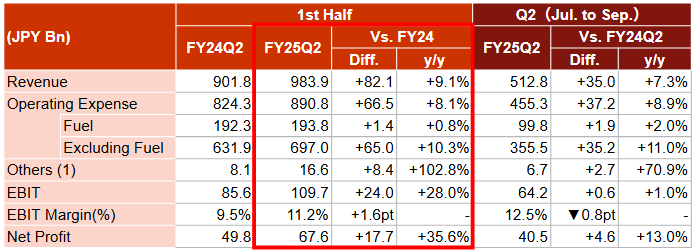

1. JAL Group Consolidated Financial Results

For the second quarter, revenue increased by 9.1% year-on-year to JPY 983.9 billion. Operating expenses increased by 8.1% year-on-year to JPY 890.8 billion due to higher variable costs linked to revenue increase, inflationary pressures, and increased investment in human capital. As a result, EBIT was JPY 109.7 billion (up 28.0% year-on-year), and net profit was JPY 67.6 billion (up 35.6% year-on-year).

(1) Others = Gain on Sales of Aircraft, Other Income, Share of Profit or Loss of Investment and Income/Expenses from Investment

(1) Others = Gain on Sales of Aircraft, Other Income, Share of Profit or Loss of Investment and Income/Expenses from Investment

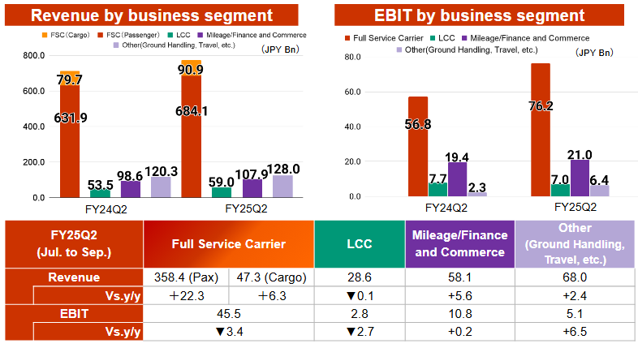

2. Performance by Business Segment

Revenue and profit increased year-on-year in the Full-service carrier, Mileage/Finance and Commerce, and Other.

Note: Revenue and EBIT in each business segment are before intersegment elimination.

Note: Revenue and EBIT in each business segment are before intersegment elimination.

Full Service Carrier Business

Strong international passenger demand, flexible revenue management capturing domestic passengers, and expansion of the freighter network contributed to cargo demand growth, resulting in revenue of JPY 775.1 billion (up 8.9% year-on-year) and EBIT of JPY 76.2 billion (up 34.1% year-on-year).

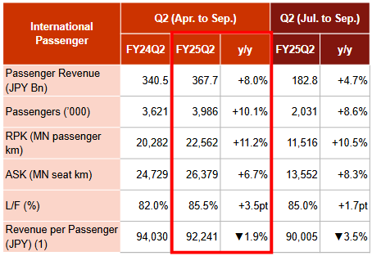

■ International Passenger

Strong inbound demand combined with moderately recovering outbound business demand from Japan drove solid passenger numbers and yields. As a result, passenger numbers increased 10.1% year-on-year, and passenger revenue grew 8.0% year-on-year.

(1) Revenue per Passenger = Passenger Revenue/Passengers

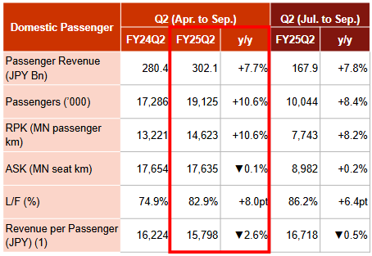

■ Domestic Passenger

Flexible revenue management led to a 10.6% increase in passenger numbers and a 7.7% increase in passenger revenue year-on-year.

(1) Revenue per Passenger = Passenger Revenue/Passengers

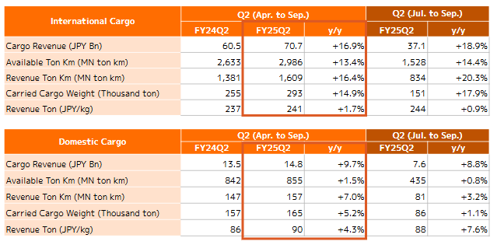

■ Cargo and Mail

International cargo revenue increased due to the expansion of the freighter network and strengthened efforts to capture cargo from China and Asia bound for North America.

Domestic cargo revenue also rose, supported by joint operations of cargo aircraft with the Yamato Group.

LCC Business

Reflecting strong growth in the LCC market, revenue increased by 10.4% year-on-year to JPY 59.0 billion, while EBIT declined 9.5% year-on-year to JPY 7.0 billion.

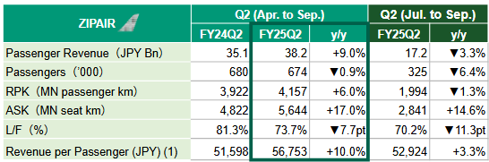

■ ZIPAIR

Despite a temporary slowdown in inbound demand, revenue increased year-on-year.

(1) Revenue per Passenger = Passenger Revenue/Passengers

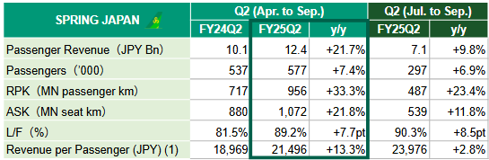

■ SPRING JAPAN

Strong passenger demand from major Chinese cities such as Beijing and Shanghai (Pudong) contributed to steady passenger revenue growth.

(1) Revenue per Passenger = Passenger Revenue/Passengers

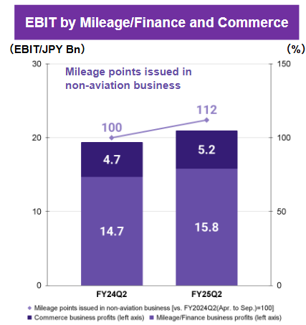

Mileage/Finance and Commerce Business

An increase in passenger numbers and a rise in miles issued associated with JAL Card payment volume resulted in revenue growth of 9.4% year-on-year to JPY 107.9 billion and EBIT growth of 8.3% year-on-year to JPY 21.0 billion, maintaining stable profit growth.

Other

Ground handling services maintained a solid performance, with revenue increasing 6.3% year-on-year to JPY 128.0 billion and EBIT of JPY 6.4 billion.

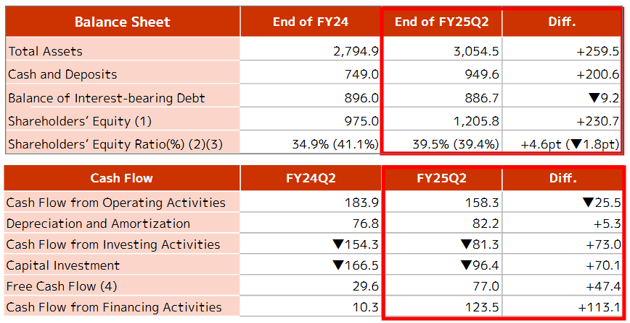

3. JAL Group Consolidated Financial Position and Cash Flow

(JPY Bn)

(JPY Bn)

(1) Equity Attributable to Owners of the Parent

(2) Ratio of Equity Attributable to Owners of the Parent to Total Assets

(3) Figures in () represent figures based on credit rating evaluation considering Hybrid Finance and Perpetual Subordinated Bonds

(4) Cash Flow from Operating Activities + Cash Flow From Investment Activities

4. Financial Forecast and Dividend for Fiscal Year Ending March 2026 and Share Buyback

- The full-year consolidated financial forecast for the fiscal year ending March 2026 remains unchanged from the forecast announced in the “Consolidated Financial Results for the Year Ended March 31, 2025” dated May 2, 2025. The forecast includes consolidated revenue of JPY 1,977.0 billion, EBIT of JPY 200.0 billion, and net profit of JPY 115.0 billion. The annual dividend forecast remains JPY 92 per share. Accordingly, the interim dividend has been set at JPY 46 per share.

- The Board approved today a share buyback of 20 billion yen as part of shareholder returns. Consequently, the company expects to achieve the shareholder return target of approximately a 50% total payout ratio.

5. Recent Initiatives

Osaka-Kansai Expo

- Three specially livery aircraft named "JAL Myaku Myaku JET" were operated on international and domestic routes to boost Expo momentum and promote regional tourism among inbound foreign visitors.

- The immersive theater "Sora Cruise by Japan Airlines" was installed, offering visitors an experience akin to riding in a flying car. During the Expo period, the theater welcomed over 120,000 visitors in total.

Passenger

- In February 2026, JTA will launch its first international scheduled route between Okinawa (Naha) and Taipei (Taoyuan), responding to strong inbound demand and leveraging the JAL Group’s network to attract visitors to Okinawa’s remote islands and other parts of Japan.

- From January 17, 2026, a Tokyo (Narita) – Delhi route will be inaugurated, increasing flights between Japan and India to three per day and responding to demand both between Japan and India as well as connecting demand between India and North America. A codeshare agreement with IndiGo will be launched to enhance customer convenience.

Cargo

A trial air and Shinkansen combined express cargo transport service "HakoByun," jointly offered with East Japan Railway Company, was conducted leveraging the speed of aircraft and Shinkansen to shorten delivery times significantly, promoting export of local products and revitalizing regional economies.

Product and Service

At the 2025 APEX EXPO, JAL was recognized as "World Class," the only Japanese airline to receive this honor for five consecutive years, particularly lauded for leading in inflight service quality.

LCC Business

- ZIPAIR will increase frequencies on the Narita–Houston, San Jose, Vancouver, Singapore, Bangkok, and Seoul routes during the winter season, partially expanding its daily operations and increasing seat capacity to meet strong demand.

- ZIPAIR will operate charter flights between Narita and Orlando from February to March 2026. This marks the first direct passenger service ever from Japan to Orlando, Florida, USA.

Mileage/Finance and Commerce Business

Starting October 21, 2025, applications opened for the third phase of the "DREAM MILES PASS" project, which supports those pursuing their dreams inspired by Shohei Ohtani. The project has received warm support and strong participation from many JAL Mileage Bank (JMB) members. For this phase, the application scope has been expanded for the first time to include teams and groups, aiming to support more young people and challengers by facilitating their travel and helping them realize their dreams.

Regional Revitalization

- The ongoing promotion of dual residence lifestyles aims to revitalize regions by encouraging relationships and connections created through mobility. This led to the launch, in July 2025, of Japan’s first sustainable model supporting local governments, dual residents, and associated stakeholders, named the "Connecting Dual Residence Living" initiative.

- The "JAL Gakutsuna Project" matches local-government-engaged students with communities, nurturing regional ties and generating involvement from younger generations.

Sustainability

- A decision was made to invest alongside oneworld alliance member airlines in the oneworld Breakthrough Energy Ventures (BEV) Fund, established to accelerate the development and production of next-generation Sustainable Aviation Fuel (SAF). This investment aims to contribute to the realization of a decarbonized society through support of innovative and cost-competitive SAF technologies.

- An investment has been made in MORISORA Bio Refinery LLC, to support the construction of a demonstration plant inside Nippon Paper’s Iwanuma mill in Miyagi Prefecture. The plant will use sustainable forest resources such as wood residues from the Tohoku region as raw materials, contributing to the realization of a "purely domestic SAF" business derived from Japanese wood.

- Since August 30, 2025, a hydrogen-fueled aircraft tug has been piloted at Haneda Airport as a first in Japan, converting a conventional vehicle to hydrogen fuel cell technology to verify operational and performance parameters while advancing airport decarbonization.

Other

From November 1, 2025, the JAL SKY MUSEUM will be renewed, extending the factory tour by 20 minutes, adding new days and evening time slots, and updating entrance facilities to enhance visitor experience.