Press Release

JAL Group Announces Consolidated Financial Results for Second Quarter Ending March 31, 2023

The JAL Group today announced the consolidated financial results for Second Quarter Ending March,

Period April 1, 2022-September 30,2022.

1. JAL Group Consolidated results

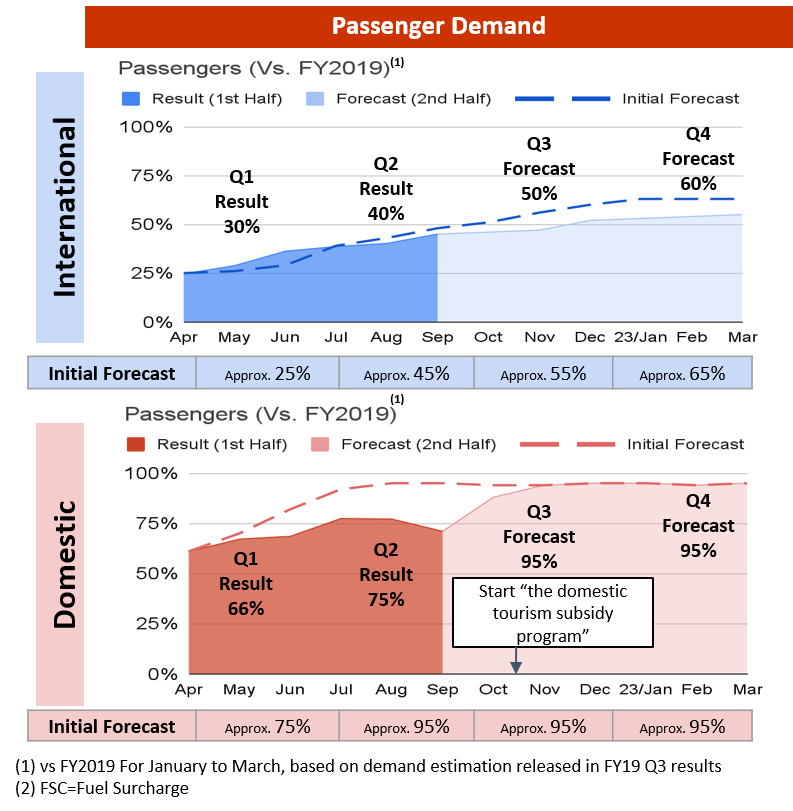

Passenger demand for both international and domestic is steadily recovering as a result of a growing trend

toward a balance of preventing the COVID-19 pandemic and socioeconomic activities. International passenger demand is gradually recovering due to continued strong transit demand between Asia and North America amid a global recovery in passenger demand, as well as a gradual recovery of demand for outbound business trips

and tourism demand. As for domestic passenger demand, strong recovery was seen during the long weekend

in May and summer holidays as balancing the infection prevention and socioeconomic activities gained

momentum, but the speed of recovery temporarily slowed due to the seventh wave of infections and

consequent increase in domestic infections. The cargo domain continued to perform strong for demand and

unit price as the supply/demand balance remained tight worldwide. The mileage business continued to record

stable earnings, and the commerce business expanded its business content with the consolidation of JALUX,

resulting in the growth of the Non-Aviation business domain.

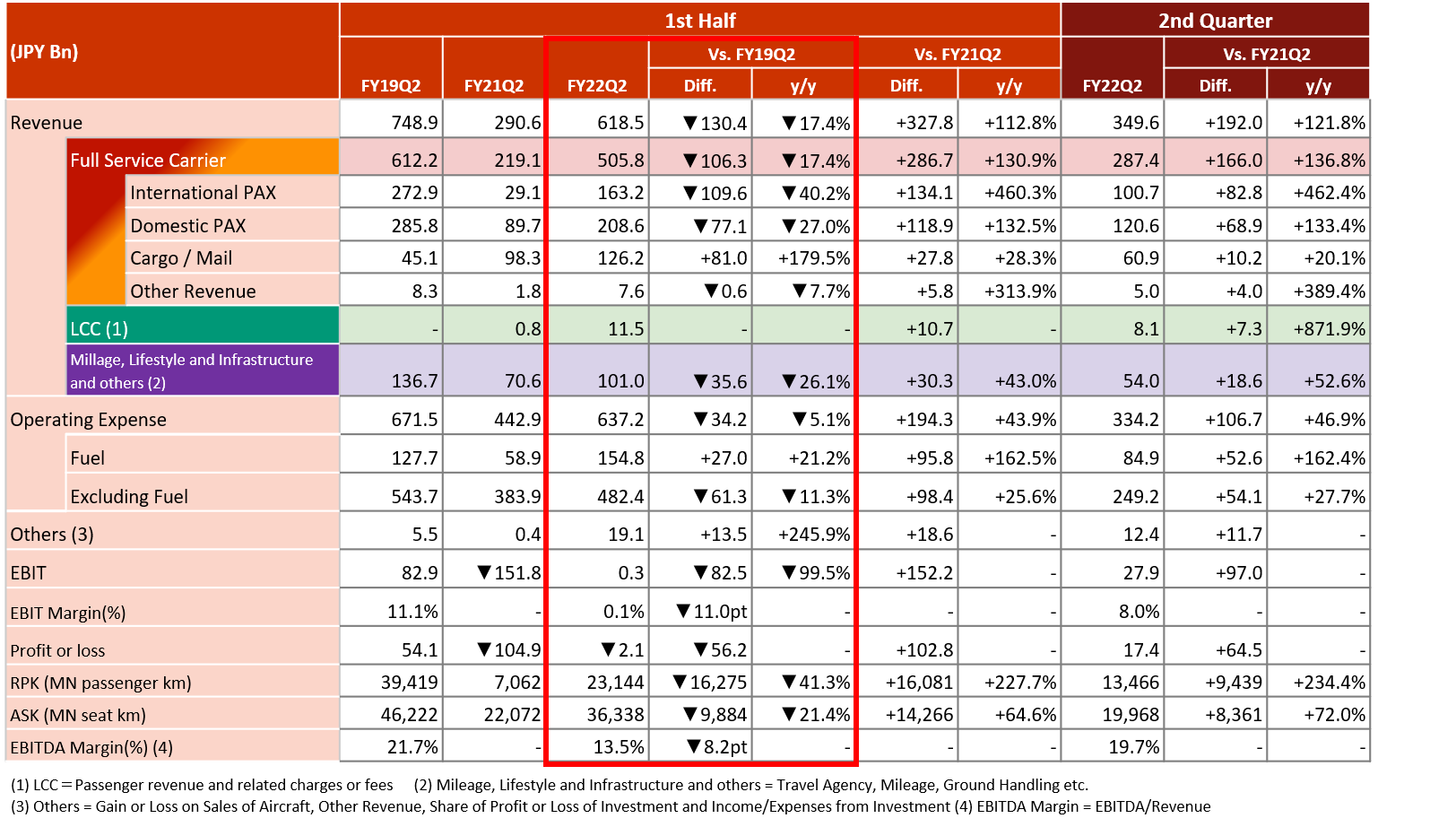

In the above business environment, the revenue for the first half increased by 112.8% year on year to 618.5

billion yen, the operating expenses increased by 43.9% year on year to 637.2 billion yen, the loss/earning

before financing and income tax (hereinafter referred as “EBIT”) was 300 million yen (year on year difference

+152.2 billion yen in the previous year). The loss attributable to owners of the parent was 2.1 billion yen (year

on year difference attributable +102.8 billion yen in the previous year). Fuel expenses for the period totaled

154.8 billion yen, which increased by 162.5% from the same period last year, and actual fixed costs amounted

to 244.6 billion yen. In the second quarter alone, EBIT was 27.9 billion yen, recording the first quarterly surplus since the third quarter of FY2019. Business performance is steadily recovering. Going forward, the entire company will make a concerted effort to further increase profits.

International passenger revenue for Full Service Carriers was 163.2 billion yen (increased by 460.3% year on

year), domestic passenger revenue was 208.6 billion yen (increased by 132.5% year on year), and cargo mail

revenue was 126.2 billion yen (increased by 28.3% year on year).

Details of the consolidated financial results are as follows (Including LCC)

Major Operating Expense Items

2. Summary of Consolidated Statement of Financial Position and Cash Flow

-Equity ratio is 39.0% and Net D/E ratio is x0.2 both in terms of credit evaluation basis, keeping a healthy level.

-Liquidity at hand was maintained at a sufficient amount of 542.9 billion yen at the end of September, as well

as the unused credit line of 250.0 billion yen, which has been reduced because of the improvement of cash

inflow.

-As a result of a recovery trend in passenger demand, Cash flow from operating activities is 120.2 billion yen,

Free cash flow is 67.7 billion yen of inflow, improving cash inflow significantly.

3. First Half and recent initiatives

【ESG strategy】

- In July, we launched “JAL Carbon Offset”, a service for corporate customers that allows companies to

visualize CO2 emissions from their business trips and offset these emissions by purchasing carbon credits.

- We also announced in November the “Sustainable Charter Flight” the first net zero CO2 emission flight to

operate in Japan. We will continue our efforts to protect the environment by providing customers with

opportunities to reduce CO2 emissions.

【Full Service Carrier business domain】

-On international routes, the cap on the number of arrivals into Japan was raised, both business travel and

tourism demand in total passengers arriving in and departing from Japan have gradually recovered. In addition, from October, with further easing of restrictions including removal of the cap on the number of people entering

Japan and exemption of short-stay visas for tourism, we expect a full-fledged recovery in demand, including

inbound travel.

-For domestic routes, despite the speed of recovery slowing in the summer due to the impact of the seventh

wave of the COVID-19 pandemic, a strong demand recovery is expected with the launch of the government's

nationwide travel support program in early October.

【LCC business domain】

- ZIPAIR Tokyo Co., Ltd. (ZIPAIR) began its sales of tickets for the San Jose route from September, which are seeing a steady increase in bookings in line with the recovery in international passenger demand and will begin its service in December. Spring Japan Co., Ltd. (Spring Japan), increased its flights on the Narita=Sapporo and Hiroshima routes starting in mid -July, and to maximize synergies as the JAL Group, it has launched a service that allows JAL mileage points to be used to pay for Spring Japan’s airline tickets, thereby steadily improving its load factor to improve its bottom line. In addition to the above two companies, the three LCCs with differing characteristics, including Jetstar Japan Co., Ltd. (Jetstar Japan) which mainly operates domestic flights, will work to build a network using Narita Airport as a hub to expand the scale of their business.

【Mileage and Lifestyle business】

-JALUX, Inc. (JALUX),has been increasing the number of BtoC touchpoints by launching the “JAL FURUSATO (hometown) Crowdfunding” website, which directly supports local government projects aimed at supporting the next generation and protecting the natural environment, in order to strengthen its commerce business.

4. Future Outlook

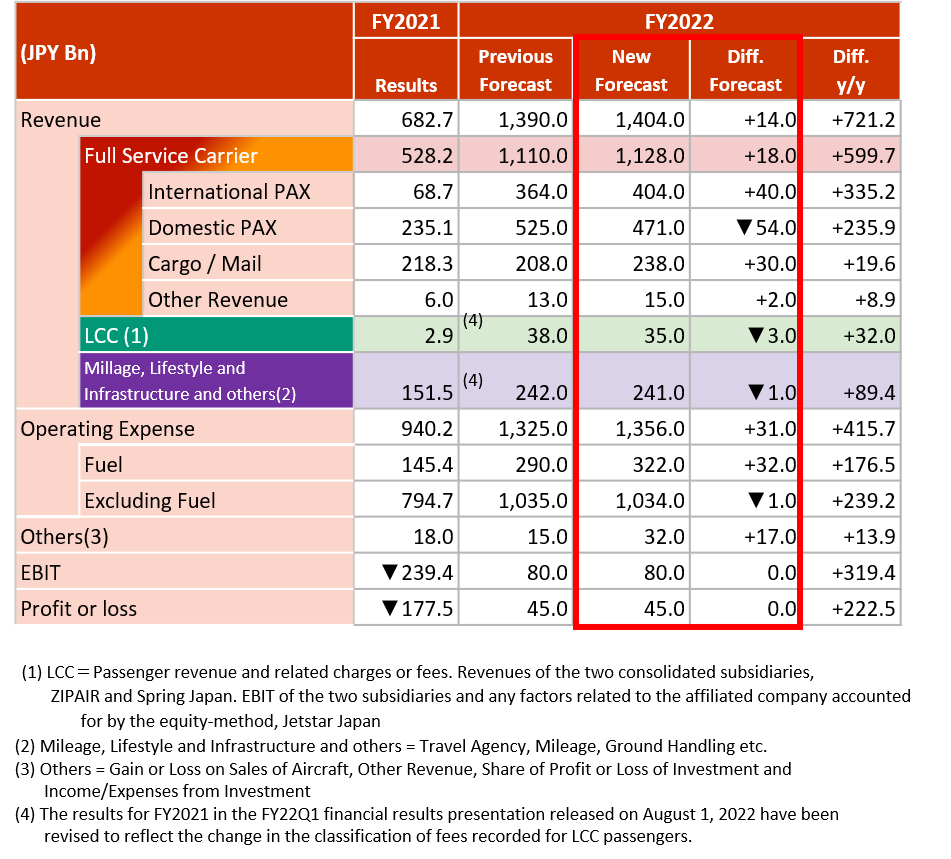

Compared to the initial forecast of the consolidated financial results announced on May 6, 2022, we forecast

domestic passenger revenue to be less than the initial forecast due to the impact of the seventh wave of the

COVID-19 pandemic, while we forecast international passenger revenue to exceed the initial forecast due to a sharp recovery in business travel from Japan and inbound demand following the drastic relaxation and

elimination of border restrictions, and revenue for cargo and mail revenue is also forecasted to exceed the

initial forecast.. As a result, the initial forecast is expected to be exceeded by 14 billion yen. In terms of

operating expenses, although fuel costs are expected to exceed the initial forecast by 32 billion yen due to the depreciation of the yen and rise in fuel prices, we expect to suppress its increase to 31 billion yen by cutting

costs other than fuel. In addition to the above, an increase in sale of assets is also expected.

As a result of the above, the forecast for profit before financing and income tax (EBIT) remains unchanged at

80 billion yen, and the forecast for profit attributable to owners of the parent remains unchanged at 45 billion

yen.

In calculating the above forecast, we have assumed a dollar-yen exchange rate of 145 yen and the market

price of Singapore kerosene, an indicator of aviation fuel costs, of US $125 per barrel.

The JAL Group will continue to take utmost precaution against its surrounding risks such as rising geopolitical

risks, weakening of the yen, rising prices of fuel and other raw materials, and the re-spread of the COVID-19

pandemic.

On the other hand, there are positive factors such as further acceleration in the recovery of international

passenger demand and strong recovery of domestic passenger demand driven by government measures such as the nationwide travel support subsidy program. Through these positive factors and also by further

strengthening our cost management, we will strive to achieve the above-mentioned financial forecast.

FY22 Full-Year Performance Forecast

5. Dividends

We will continue to make every effort to provide year-end dividends to meet the expectations of our

shareholders, who have supported us throughout the COVID-19 pandemic. Year-end dividends and annual

dividend forecasts will be disclosed as soon as we are able to assess the business environment going forward and the situation becomes more visible.